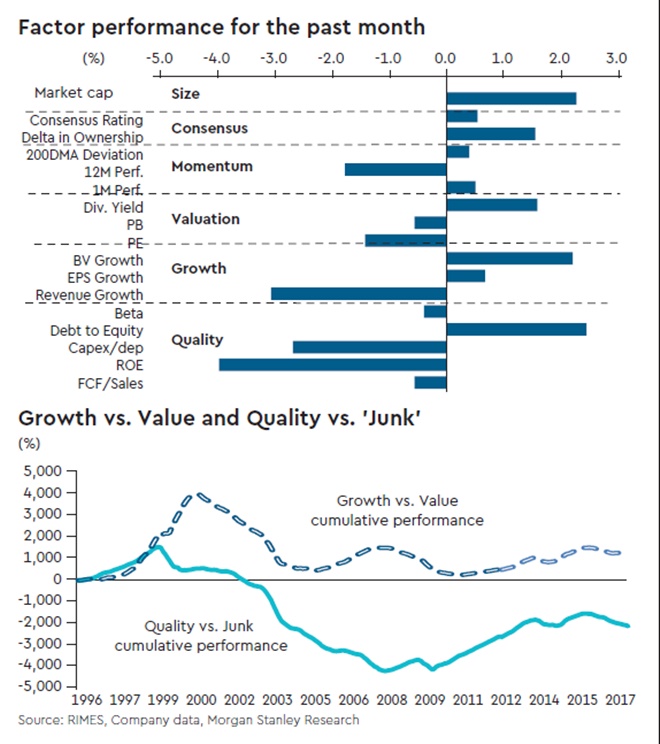

2017 was marked by a strong and uptrending market with few factors seeing consistent strong performance. Buying high beta, 12M performance and avoiding high RoE stocks was the most productive approach for the year. Junk factors were the biggest outperformer by a margin while quality was the biggest underperformer. Momentum was the second best style. Both growth and value fared better than quality—a trend that remained intact since the start of the year.

December trends: Beta, large caps and strong BV growth were the places to hide in December while owning high RoE would have proved to be painful again. Stocks of companies with high capex to depreciation were also out of favour in December.

The ongoing transition to Growth at a Reasonable Price (GARP): From 2008 to 2013, the market remained firmly in favour of quality, defined by high ROE, high FCF, low debt to equity, low beta, and a low ratio of capex to depreciation. It chose quality over “junk”, defensive over cyclical, and large cap over small cap. Since 2014, quality has been progressively losing ground in favour of high beta and momentum. Overall, we reckon that the market appears to be in a shift to growth and value, i.e., GARP.

The distinction between growth and quality: There are four ways to participate in growth—companies with strong trailing capex, companies with robust trailing book growth, strong trailing positive earnings revisions or companies with the best forward revenue or EPS growth. Growth should be distinguished from quality, even though there are stocks that straddle these categories. The former is about strong EPS, book value or revenue growth and positive change in return on capital; the latter is about positive free cash flow and the level of return on capital. Even if companies generate the latter, they might not report growth on a 12- to 18-month view. We think large-cap growth stocks trading at reasonable valuations may continue to be the template for the coming months. The risk to this view is that if the growth cycle falters, it could lead to a bounce back from quality stocks.