Successful stock investing requires a clear understanding of your goals and risk appetite. It also needs thorough research using both fundamental and technical tools.

Monitoring key financial metrics and maintaining a balanced portfolio aligned with your risk tolerance are essential to managing risk and maximising returns.

To follow these steps, some investors replicate the portfolios of investment gurus.

One such esteemed investor whose every investment garners attention is Madhusudan Kela.

Who is Madhusudan Kela?

Known for his ability to identify quality companies with strong growth prospects, Madhusudan Kela is one of the most well-known and seasoned investors in the Indian stock market, with extensive experience of over 27 years.

He prefers a value investing style and has a long-term investment horizon.

Which Stock Did Madhusudan Kela Buy and Why?

Madhusudan Kela acquired a significant stake in Windsor Machines during Q4 FY25. He bought approximately 7.7% of the company’s shares, which amounts to about 6.5 million shares.

Prior to this he did not hold any stake in the company.

While the reasons for his buying a stake remain unclear, here a few a few points that can explain the decision.

#1 Potential Turnaround

The first reason could be improving financial performance.

If we see the acquisition has happened in the period spanning Q4 FY25. This means Madhusudan Kela could have studied the financial performance up to Q3 FY25.

The company reported a turnaround in performance in the Q3 FY25 after losses in the previous three quarters. The net profits surged to Rs 417 m. Sales too improved to Rs 1,077 m from Rs 870 in Q3 FY24.

Clearly, a solid improvement in financials could be one of the reasons for Madhusudan Kela to pick a stake in the company.

#2 Growth Plans

The company is investing heavily in research and development. After successfully developing the Platen machine models, KL1600, KL2000, and KL2300, the company is now implementing the KL3200 machine.

Windsor Machines has launched new products such as the SPRINT-800 and high-tonnage two-platen injection molding machines, enhancing its product portfolio for domestic and international markets.

While the company does not disclose its order book position, according to media reports, these could be substantial.

The growth potential could be one of the reasons for Madhusudan Kela to invest in the stock.

What Next?

By 2027, the plastics industry is expected to generate US$ 122.54 billion in annual revenue, with two lakh tonnes of exports, as per industry estimates.

The surge in plastic demand augurs well for Windsor Machines going forward.

The company will also be investing in R&D in the coming years. The new models that are launched are expected to benefit the company’s sales in the years to come.

That said, Windsor Machines once again reported losses. From a turnaround in Q3 FY25, Windsor Machines slipped back into losses in Q4 FY25. The company reported a net loss of Rs 41 m in the quarter.

However, revenues surged to Rs 1,208 m compared to Rs 1,094 m in the corresponding period last year.

How Shares of Windsor Machines has Performed?

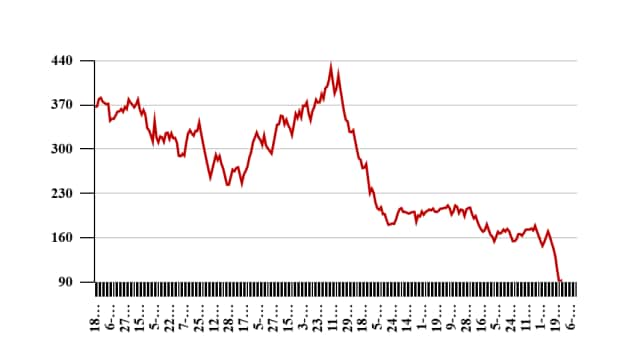

In the past five days, Windsor Machines stock is down 5%. In the last one month, the share price has fallen about 4%. In the past one year, the share price has gained about 176%.

The stock touched its 52-week high of Rs 440.75 on 13 December 2024 and its 52-week low of Rs 118.5 on 19 June 2024.

Windsor Machines Share Price 1-Year

About Windsor Machines

Windsor Machines is one of India’s largest and oldest manufacturers of plastic processing machinery, with over six decades of experience since its incorporation in 1963.

The company specialises in manufacturing and selling a wide range of plastic machinery, including injection moulding machines, extrusion lines, and blown film lines, serving diverse industries such as household goods, furniture, healthcare, electrical and electronics, automobile, agriculture, and packaging.

Windsor Machines operates major manufacturing plants in Gujarat equipped for extrusion and injection molding machinery production.

To know what’s moving the Indian stock markets today, check out the most recent share market updates here.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.