The big financial news doing the rounds in the Indian rupee’s fall to 90 to a dollar. A USDINR rate of 90 is not surprising by itself because the Indian currency has a history of depreciation.

However, the sharp fall from 85 to 90 has taken only 5 months. This move has shake up the idea that the rupee has been stable or rangebound.

We have written about the reasons for the decline in this editorial – Why the Rupee is Falling.

In this editorial, we will cover the impact of the declining rupee on specific listed Indian stocks.

Read on…

Impact on the stock market

A weak rupee has negative consequences for the Indian economy. The biggest concern is called ‘imported inflation’. India is a net importing country. This means import more that we export. As the US dollar is the world’s reserve currency, it’s also the world main invoicing currency for goods and services. If the rupee gets weaker against the dollar, the cost of all our imports goes up.

Investors in the stock market will need to be aware of this. There will be winners and losers in the economy due to a depreciating rupee in the short term.

The winners would be exporters. They can either pocket the extra earnings as higher margins or offer higher discounts to global customers to increase market share. The losers would be importers. They would either have to absorb the currency depreciation in the form of lower margins or would have to raise prices, which would hurt their sales volume.

However, in the long term, the underlying fundamentals of the companies will be the deciding factor of stock market returns, and not currency movements. Thus, long term investors who have picked fundamentally strong stocks at reasonable valuations don’t have much too worry about when it comes to a falling rupee.

With that said, let’s look at 5 companies that could benefit from a falling rupee…

#1 Infosys

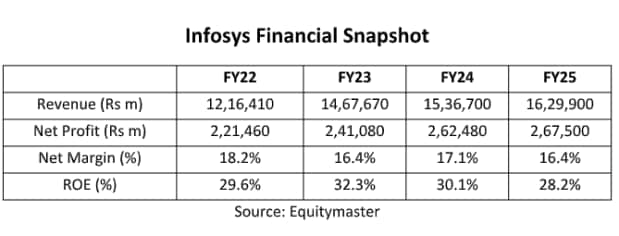

IT stocks tend to benefit from a falling rupee as most of their revenue is designed in foreign currencies, especially the US dollar. In the case of Infosys, nearly US$ 12 billion (bn) of revenue originates in the US which comes close to 60% of the company’s total revenue.

Now, the company will have to pass on some of the benefit to its customers. So, it can’t pocket the entire amount that it will gain from the rupee’s decline. However, the company will benefit on the operating margin front. Whatever, amount of the decline the company does retain will show up as an improvement in its margin.

Does this guarantee a jump in the net profit?

Not necessarily.

In the case of large companies like Infosys, there are many factors that influence margins on a quarterly basis. But this is a positive factor for the company.

Infosys can also use the lower value of the currency in a tactical manner to win additional business by offering a higher than usual discount. This can be done in the case of very cost conscious clients or if the company badly wants to retain a particular customer.

But these are special cases that investors should not worry about too much. At the end of the day, the company’s long term prospects will be decided by the quality of its services.

#2 Sun Pharma

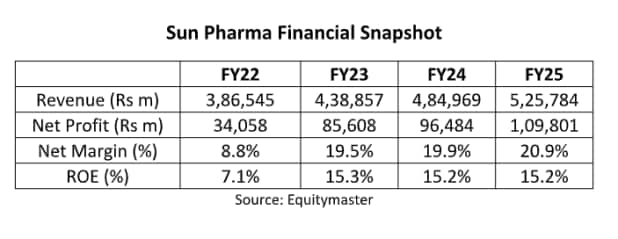

In FY25, about 31% of the company’s revenue came from the US, about US$ 2 bn. The US market is very important for the company, not just from a revenue perspective but also from a pricing perspective.

The company is trying to offset pricing pressure in the generics business by driving the growth of its speciality drugs segment – Global Innovative Medicines. The US is the world’s biggest market for speciality drugs and thus, any falling currency can be beneficial to Sun Pharma.

However, the company will have to decide how best to take advantage of it. It can choose to pocket the gains to boost its margins or it can pass on the benefit to consumers with discounts. This holds the potential to win additional business or new clients.

The company has done well to gain market share in the US over the years, so the second option could be employed.

#3 Tata Motors Passenger Vehicles Ltd

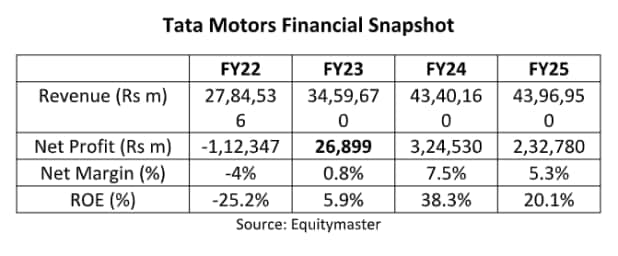

The flagship manufacturing company of the Tata group and one of India’s top auto firms, is also a major exporter. To the US, the company primarily sells the JLR brand of vehicles. While the company doesn’t give a break up of revenue specifically from the US, it does share the sales volume from North America. This was 15% in FY25 for the company on a consolidated basis.

This is also about 23% of the total sales of JLR in FY25. The US tariffs on India have impacted the company to an extent. The company has acknowledged the same in its quarterly results. However, a potential trade deal between the US and India could alleviate the pressure on JLR but this remains to be seen.

In the meantime, a falling rupee could offer some relief. How the company accounts for the same will be known at the time of the December quarter results.

The company’s stock is in the news due to its ongoing demerger but investors should also keep in mind relatively smaller points like currency fluctuations. This is because Tata Motors is an MNC which reports results in rupees and thus, it’s financial results will be impacted by the USDINR.

Conclusion

The upcoming results season in January 2026 will reveal the impact of the rupee’s depreciation on the financials of corporate India.

Will exporters benefit? By how much?

Will importers be hurt? By how much?

Speculators will aim to make short term profits from the market’s expectations on this front. However, long term investors should not let this event affect their investing process. The time tested idea of finding fundamentally strong stocks and investing in them for the long term at reasonable prices is the way to go.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/

writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary