The Indian government has been hiking defence production. Escalating geopolitical tensions has led the government to prioritise military readiness.

In fact, it recently announced that India’s defence production reached a new record high of Rs 1,506 billion (bn) in FY25, an 18% increase over the previous year’s Rs 1,270 bn.

This has increased investor interest in defence stocks.

Here are two smallcap defence stocks that are likely to benefit from the increased defence spending by the government.

#1 Premier Explosives

First on our list is Premier Explosives.

Premier Explosives specialises in the manufacture of high energy materials and allied products, including industrial explosives, detonators, bulk explosives, packaged explosives, detonating fuses, solid propellants, pyrogen igniters, and related products.

The company has been a pioneer in indigenising technology for manufacturing explosives and accessories in India.

As of early August 2025, the company has an outstanding order book stands at Rs 9,885 m, forming 2.4 times the FY25 revenue.

The defence segment order book stands at Rs 8,600 m, which is equal to 87% of the total order book.

In Q1 FY26, the company secured orders from Brahmos Aerospace for propellant casting and booster assembly and from overseas clients for rocket motors and commercial explosives, which are at different stages of execution.

Coming to financials, in Q1 FY26 Premier Explosives reported consolidated net sales of Rs 1,421 m against Rs 829 m in the corresponding period last year.

The net profits for Q1 FY26 were Rs 154 m against Rs 73 m YoY. Net profits grew by a solid 110%.

Coming to the future outlook, Premier Explosives is the only Indian company qualified to manufacture countermeasures and specialises in exporting fully assembled rocket motors.

Along with rocket motors, it also manufactures and exports warheads, mines, and ammunition under Atmanirbhar Bharat initiative.

With the Ministry of Defence promoting domestic production and reducing imports, this policy supports the company’s growth.

How Shares of Premier Explosives Have Performed

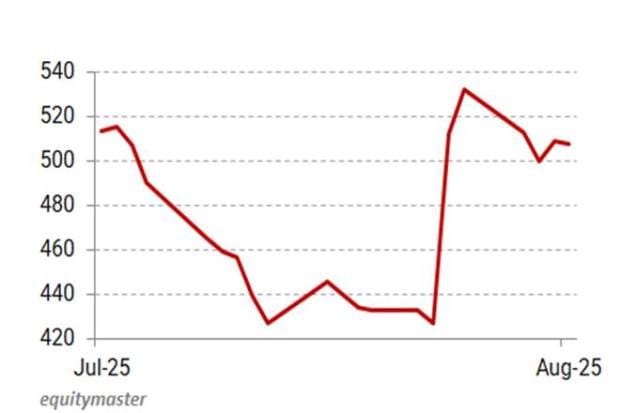

In the past five days, Premier Explosives shares have gained to Rs 538 from Rs 531. In the last one month, the share price has gained about 4.5%. In the last one year, the shares have lost 7%.

The stock touched its 52-week high of Rs 667 on 6 June 2025 and its 52-week low of Rs 308.95 on 7 April 2025.

Premier Explosives Share Price – 1 Month

Data Source: BSE

#2 Paras Defence & Space Technologies

Second on our list is Paras Defence & Space Technologies.

Paras Defence and Space Technologies is engaged in defence engineering, specialising in the design, development, manufacturing, testing, and commissioning of products, systems, and solutions for defence and space applications.

Paras Defence has an order book of more than Rs 10 bn and is targeting achieving an order book of Rs 15 bn in the near term.

The company recently received an order from BEL valued at approximately Rs 453.2 m for supply of signal and data processing systems and multi-sensor fusion systems.

Coming to the financials, the company reported net sales of Rs 932 m for Q1 FY26, which was better than Rs 836 m on a YoY basis.

The net profits for Q1 FY26 came in at Rs 143 m compared to Rs 141 m in the corresponding period last year.

The management says they are confident of sustaining the growth momentum through FY26.

The company has a strong pipeline of opportunities, driven by India’s push for self-reliance in defence manufacturing, and has robust growth prospects ahead based on order inflows.

How Shares of Paras Defence & Space Technologies Have Performed

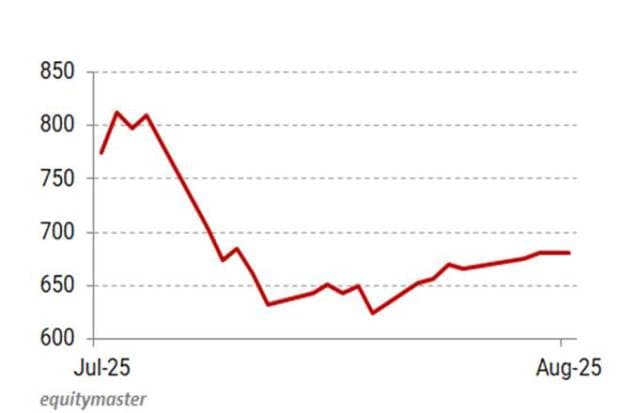

In the past five days, Paras Defence and Space Technologies shares have moved slightly higher to Rs 686.5 from Rs 666. In the last one month, the share price is down about 15.5%. In the last one year, the shares have gained 6%.

The stock touched its 52-week high of Rs 971.8 on 19 May 2025 and its 52-week low of Rs 401 on 7 April 2025.

Paras Defence & Space Technologies Share Price – 1 Month

Data Source: BSE

Conclusion

Rising regional tensions and security concerns have accelerated the modernisation and expansion of our armed forces.

The Indian government is strongly promoting domestic manufacturing of defence equipment to reduce dependence on imports.

The government has allocated its highest-ever defence budget in 2025, with a substantial part dedicated to capital expenditure for new weapons, aircraft, ships, and infrastructure. These initiatives should benefit leading defence companies in India.

To know what’s moving the Indian stock markets today, check out the most recent share market updates here.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.