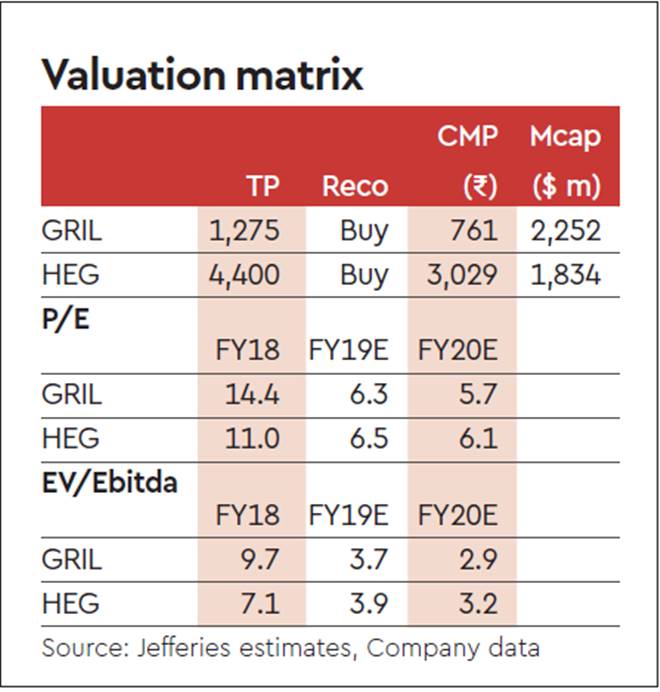

We recently interacted with HEG and Graphite India’s (GRIL’s) management. Demand supply tightness continues, with contracts signed for the next two quarters at higher electrode prices vs Q4 realisation. Both GRIL and HEG are down 16-18% from their peak share prices. GRIL and HEG are currently trading at cheap valuations of 2.9x and 3.2x FY20e EV/Ebitda, resp. providing a good buying opportunity. Maintain Buy with price target of Rs 1,275 for GRIL and Rs 4,400 for HEG.

Demand Supply tightness…

China’s steel exports fell by 31% y-o-y in CY17 and further fell by 21% y-o-y in YTDCY18. This led to the revival of steel manufacturing in importing countries which predominantly produce steel via Electric Arc Furnace route. This, in turn, revived the demand for graphite electrodes. The constrained supply of needle coke and consolidation in electrode industry is restricting the increase in the supply of electrodes. Both managements highlighted that demand-supply tightness remains high.

…leading to higher realisation

Graftech in the last analyst call highlighted spot prices being in the range of $17,000-23,000/t giving a sense of the tight demand-supply situation. HEG and GRIL management highlighted booking new contracts at higher prices as compared to Q4FY18 realisation. We are building in electrode realisation at $12,500/t and $13,500/t in FY19e and FY20e respectively.

Strong Q1FY19e on cards

GRIL management said the majority of its legacy contracts were serviced in Q4FY18. New contracts signed at higher prices, coupled with a rise in domestic prices, will lead to higher realisation in Q1. HEG management said Q1FY19e will be better than Q4FY18 as the high prices of needle coke will only have an impact in Q2FY19e.

Needle coke capacity debottle-necking to improve utilisation

The world’s largest manufacturer of needle coke, Phillips 66 is debottlenecking its refinery. As per estimates, this will lead to an increase in production capacity by about 15-20%. Mostly driven by this, HEG and GRIL have revised their guidance on utilisation levels to upwards of 85% for FY19E. However, we have kept our utilisation at 80%.

Additional Surveillance Measures

Recently, SEBI along with exchanges added HEG and GRIL, along with 25 other securities, to the ASM list. This reduced the price band to 5% from 20% and margins to be levied at 100% (no intra-day trading). The published notice also says that it should not be construed as an adverse action against the companies. However, post the event both the stocks are down 14% and we believe it provides a good buying opportunity for both the names.

Remain positive on graphite electrode sector

Recent commentary on tightness in supply demand from Graftech and upside revision in revenue guidance in Q1 itself by Tokai Carbon outlines the industry’s strong fundamental outlook. Both GRIL and HEG reported strong Q4 results and guided for stronger results going forward. We maintain Buy on GRIL with price target of Rs 1,275/sh and on HEG with PT of Rs 4,400/ share.