Core revenue growth slowed as expected, given (i) slower loan growth (down 2% q-o-q and flat y-o-y); (ii) lower margins (down 8bps q-o-q); and (iii) lower fees (down ~45% y-o-y). Operating expenses were down 2% y-o-y but below our estimate – this drove a 22% core PPoP miss. The bank made further contingency provisions, which were partly offset by strong capital gains. F1Q21 EPS declined 56% y-o-y and was ~10% below our estimate. Overall moratorium level improved sharply to 14% in June vs. 33% in April.

The improvement in moratorium was led by wholesale banking, where moratorium level improved from 22% to 5% of loans. Non-wholesale banking moratorium improved to 30% vs. 45% – while most segments improved, led by MFI (~75% collection efficiency in July), credit card portfolio improvement was relatively milder – from 24% to 22% of loans. The bank mentioned that ~51% of current moratorium loans are from Moratorium 1.0 and 25% have paid in July. This implies that customers who haven’t paid any amount over the past 4-5 months would be in high single digits. The bank mentioned that 70% of the credit card moratorium pool is salaried and 95% of the customers have never been delinquent historically.

The bank made more contingency provisions (Rs 2.4 bn in F1Q) and total stock is now at `3.5 bn (0.6% of loans). It said this was mainly towards the credit card portfolio. For F21, the bank maintained its credit costs guidance at a level similar to F20 (3.4%), mainly driven by the retail/SME segments. Liquidity position is strong with LCR at 163%. Deposits grew 7% q-o-q in F1Q21; the bank noted that the growth was broad-based across segments. It has also started to reduce rates on term deposits over the past few months.

On growth, the bank sounded cautious; it expects a gradual pick-up in 2HF21 Bank is closely tracking COVID-19 case counts, as the continued rise is leading to some fresh/repeat lockdowns and impact on business operations. Growth would be led by non-wholesale banking loans, the share of which has increased from 44% in F19 to 53% in F1Q21. Wholesale banking portfolio fell 18% y-o-y in F1Q21 and we expect continued moderation (non-wholesale banking grew 24% y-o-y, down ~8% q-o-q). CET 1 ratio was 15.2% vs. 15.3% last quarter.

Valuation is inexpensive, but lack of visibility on asset quality and muted RoE estimates keep us UW

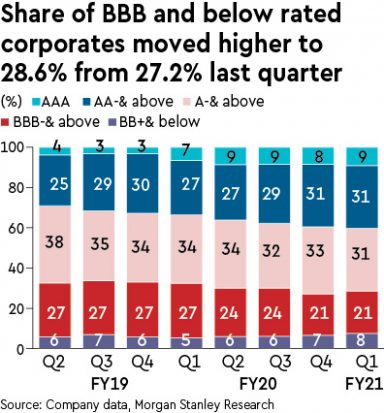

This is driven by high exposure to BBB and below-rated corporates and unsecured retail loan segments.