Reported PAT at ~Rs 2.5 bn was in line with our expectations aided by NIM improvement and market share gains. Management expects strong growth momentum to continue and operating leverage to play, as most businesses have achieved reasonable scale. Investment in technology and distribution franchise to continue, with plans to add

60-80 branches in FY20 (mainly in tier-1 and tier-2 cities). Delta in RoA (1.5% exit RoA in FY20) to be driven by stable NIM, lower credit costs and better operating leverage. RBL’s current investment phase will be over by FY20 end, requirement for incremental investment will reduce substantially, creating room for operating leverage (current cost to income at 51.2% with 324 branches and 993 BC branches) and increasing share of high-yielding portfolio will be RoA accretive. We have Buy rating on the stock.

Also read: Blockbuster IPO: Neogen Chemicals issue subscribed over 40 times last day; sees stellar demand

Q4FY19 highlights

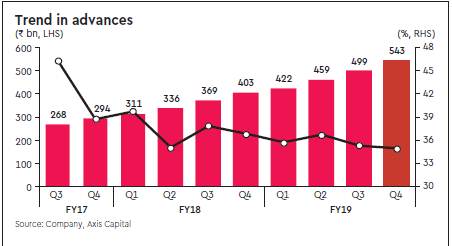

(i) Advances grew 34.9% y-o-y, driven by non-wholesale book, up 49.4% y-o-y, while growth in wholesale book moderated to 25.2% y-o-y. Within non-wholesale book, credit card (up 135.4% y-o-y), MSME (72.8% y-o-y) and LAP (55.1%y-o-y) grew the most; (ii) bank added 340k credit cards during Q4 and reached its target of 1.7 mn cards in FY19 (likely to double this base over 18 months); (iii) NIM improved 11 bps q-o-q to 4.23% due to increase in yield in both wholesale and non-wholesale book on increase in MCLR and change in asset mix; (iv) Fresh slippages were lower at Rs 2.06 bn (2.1% of loans vs. 2.3% in Q3); and (v) increase in GNPLs were primarily from corporate, agri and retail book, while GNPLs in DB&FI and commercial banking book declined sequentially.

We have BUY rating; revise TP to Rs 780

We expect RBL to scale up materially (2x balance sheet by FY21) benefiting from increased share of high-yielding businesses (25% of book), granular and diversified loan book (share of retail to increase to 50% by FY21), pan-India presence (380 branches by FY20) and room for operating leverage (80%+ branches to break even by FY21 end). At CMP of Rs 676, RBL trades at 3.5x/3.0x FY20e/21e P/ABV of Rs 192/222 (we have not assumed any dilution in our estimates).