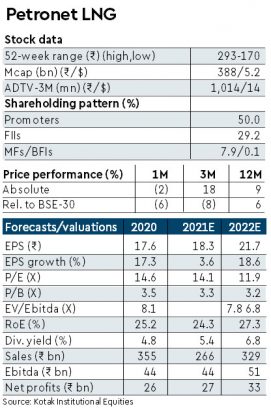

PLNG’s Q1FY21 results were modestly ahead of our estimates reflecting marginally higher-than-expected volumes amid a challenging environment. We retain our constructive stance seeking comfort from prudence on capital allocation, limited risks to volumes/tariffs/earnings and attractive valuations at 12X FY2022e EPS. We reiterate Buy with FV of Rs 300, expecting the company to deliver healthy 10-11% CAGR in earnings over the next 3-5 years driven by higher volumes and tariffs.

Q1FY21 results modestly above estimates with volumes moderating

PLNG’s Ebitda declined 11% y-o-y and 10% q-o-q to Rs 9.1 bn in Q1FY21, 3% above our estimate reflecting modestly higher-than-expected volumes and a sharper-than-anticipated reduction in operating expenses. Overall volumes were 2% above our estimate, declining 13% q-o-q and 16% y-o-y to 190 tn BTUs. Utilisation at Dahej terminal moderated to 81% from 103% in the previous quarter reflecting a reduction in demand due to the lockdown. LNG off-take from Dahej reduced to 181 tn BTUs in Q1FY21 from 206 tn BTUs in the previous quarter. Kochi terminal supplied 9 tn BTUs of LNG, with utilisation moderating to 14%.

Reduction in operating expenses reflected lower volumes as well as lower repair and maintenance expenses. Adjusted PBT, excluding Rs 680 mn of impact from lease accounting under Ind-AS 116, declined 14% y-o-y to Rs 7.6 bn and PBT, including Ind-AS 116 impact, declined 17% y-o-y to Rs 7 bn. Adjusted net income declined 7% y-o-y and 11% q-o-q to Rs 5.2 bn (EPS of Rs 3.5), 3% above our estimate, as lower interest and depreciation expense was offset by lower other income.

Dahej utilisation expected at ~100% in Q2FY21; Kochi-Mangalore pipeline likely by end-August

In the post-results conference call, PLNG management indicated—(i) utilisation at the Dahej terminal has increased to 104% currently and the management is confident of achieving ~100% utilisation for Q2FY21; Kochi utilisation has also increased to ~20%; (ii) Kochi-Mangalore pipeline is likely to be completed by the end of this month, following which utilisation at the Kochi terminal is anticipated to increase to 30-35%; (iii) there has been no material progress on the Tellurian MoU or Sri Lanka/ Bangladesh projects for now; (iv) PLNG initiated force majeure on nine LNG cargoes in Q1FY21; (v) PLNG is evaluating long-term LNG sourcing contracts; and (vi) capex is expected to be around Rs 3.5 bn for FY2021.

Fine-tune EPS estimates; reiterate BUY with unchanged Fair Value of Rs 300

We reduce our FY2021-23 EPS estimates modestly by ~2% factoring in (i) modestly lower volumes; (ii) higher regasification tariff for Kochi at Rs 83.1/mn BTU as the company escalated tariffs by 5% from Q1FY21; and (iii) other minor changes. We reiterate Buy with DCF-based FV of Rs 300 noting (i) healthy 10-11% CAGR in earnings over the next 3-5 years; (ii) reasonable valuation at 12X FY2022e EPS; and (iii) high FCF/dividend yield of 6-7% pending final decisions on large investment proposals, which may be unlikely to be approved soon given PLNG’s strategy of seeking long-term commitments along with 16% IRR threshold.