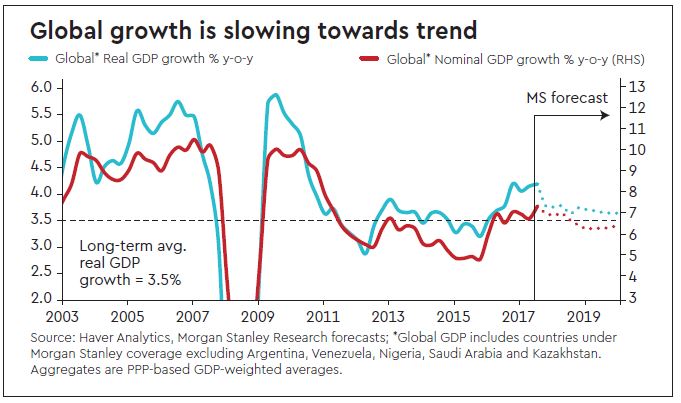

We expect global growth to slow to 3.6%Y in 2019 from 3.8%Y in 2018. The 2019 macro outlook is likely to be shaped and supported by the following three divergences:

Growth – DMs slow, EMs stabilise

The growth differential will swing back in favour of emerging markets (EM). Developed markets (DM) growth slows in 2019, mainly driven by the US, as tighter resources and less supportive policy weigh on growth. Easing measures work and stabilise growth in China. Receding external headwinds allow growth to hold up in EM ex China, enabling EMs to retake the lead in driving global growth.

Core inflation – making new highs in Developed Markets, staying low in EM

Tighter labour markets continue to lift wage growth, bringing core inflation gradually higher in Developed Markets. In the United States and euro area, core inflation makes new cycle highs in 2019. In contrast, a still favourable domestic policy mix keeps core inflation in Emerging Markets well-anchored at relatively low levels.

Central banks – the Fed pauses while others hike

The Fed pauses after reaching neutral and ends balance sheet run-off in Q3FY19. The ECB and BoJ embark on the next stage of policy normalisation and hike rates. Real rates do not rise meaningfully in EM, while China’s easing measures help to take broad credit growth modestly higher.

Risks – US corporate credit risks, trade tensions, USD strength

Given that the cycle is maturing, we see risks skewed to the downside, with a possibility of a global recession in our bear case. We view US corporate credit as the key risk to watch while trade tensions could be the most immediate risk to play out pending the outcome of potential negotiations between the US and China.

2019 outlook – three key divergences

2018 had two halves, as global growth clocked at 4%Y in the first half before decelerating to 3.6%Y in the second. Our forecast for 2019 is that global growth will slow towards trend, with risks skewed to the downside. This aggregate headline figure does not do justice to the underlying dynamics. Save for the single year of synchronous growth in 2017, the global cycle has been marked by divergent trends.

2018 – a bad year for EMs especially

The US economy continued to power ahead in 2018 while growth faltered in the rest of the world. However, the pain was a lot more pronounced for EMs. Interest rates moving higher in the US and a stronger US dollar led to a tightening of financial conditions in EM. At the same time, with oil production in the US touching highs, the rise in oil prices provided another fillip to the dollar. This, coupled with trade tensions, rendered EM economies nearly defenceless against the barrage of external headwinds and ultimately resulted in slower growth in 2H18.