Motherson Sumi Systems’ (MSS’) Q4FY21 operating earnings were in line with consensus estimates as Ebitda margin came in at 10.1% (up 154bps y-o-y). However, FCF generation for FY21 positively surprised consensus at ~Rs 30.3 bn leading to net debt reduction (ex-leases) at Rs 48 bn (down ~Rs 21 bn y-o-y/ lowest ever debt/Ebitda: 1.2x). Management expects SMP’s greenfield plants to reach PBT breakeven soon (we expect FY22); this is likely to boost earnings growth in FY23.

DWH business is likely to unlock value (post restructuring) as one of the best proxies of electrification/hybrid theme in India. Japanese partnership, technological strength and top-quartile financials are likely to create scarcity premia for it. Overall, we continue to like the FCF generation construct; stock remains attractive with FCF yield of ~4%/6%/11% for FY21/FY22/FY23, respectively. Maintain Buy.

Key highlights of the quarter: Overall consolidated revenues stood at ~Rs 169 bn (up ~18% y-o-y) led by PKC (up ~27% in EUR terms). The standalone business reported revenue growth of ~28% to ~Rs 12.7 bn as margins were lower at 13.7% (down 78bps) due to quarter lag of RM pass-through. PKC and SMR witnessed 15bps and 166bps y-o-y contraction in reported margins at 8% and 12.9%, respectively, while SMP reported 411bps expansion at 8.7%. Strong cashflows aided debt reduction (net debt down by ~Rs 14 bn q-o-q).

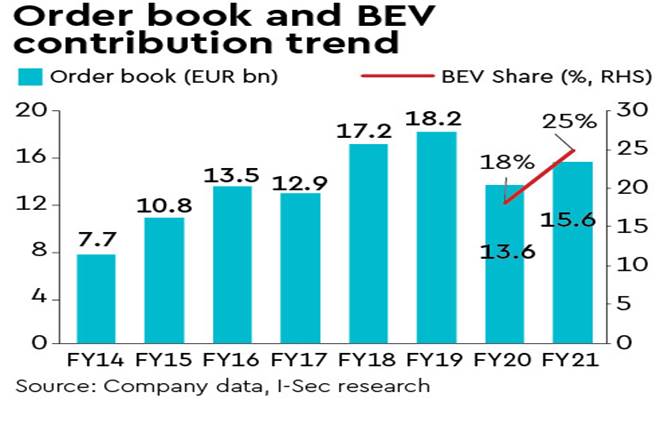

Key takeaways from earnings call: (i) Orderbook size reached EUR15.6 bn (25% from EVs) with EUR4.5 bn of new orders in H2FY21; EV order execution to be ramped up as customer programmes gather pace; (ii) SMRPBV witnessed strong working capital improvement (down from 11 to 5 days); overall capex for MSS to be Maintain Buy: The robust orderbook growth (20% jump over H1FY21) at EUR15.6 bn increasing BEV content (share of pure BEV orderbook at 25% vis-a-vis 21% in H1), is likely to support content per vehicle increase thesis.

The current plants would be adequate to execute this expanding orderbook, thus leading to faster asset-sweating and RoCE improvement. We revise our earnings estimates by -0.7%/5.1% for FY22E/FY23E. We value the company on SOTP basis, with a revised TP of Rs 310/share (earlier: Rs 253).