Bank of India reported a weak set of earnings due to high provisions for bad loans as well as up fronting of provisions on loans sold to ARC and certain AQR related exposure. Tier-1 ratio has improved to 9%, slippages are not showing worsening trends and recovery trends have been maintained which should offer adequate cushion to this inexpensive bank. Maintain ADD though upside would be realised only when there is greater comfort on impairment ratios.

High provisions continue to dent performance

BoI reported a loss led by high provisions for bad loans and certain one-off provisions relating to prior period transactions. The bank has provided Rs 1.1 billion for AQR related exposures and R2.1 bn on account of loss on loans sold to ARC. Revenues have grown 7% y-o-y but NII declined 5% y-o-y due to high income de-recognition. Loan growth has slowed to 0.5% y-o-y and is only being led by the retail segment (13% y-o-y) while corporate loans declined 8% y-o-y. NIM is still weak at 2.2% but the two quarters’ improvement continued. However, growth in non-interest income was led by treasury and forex income.

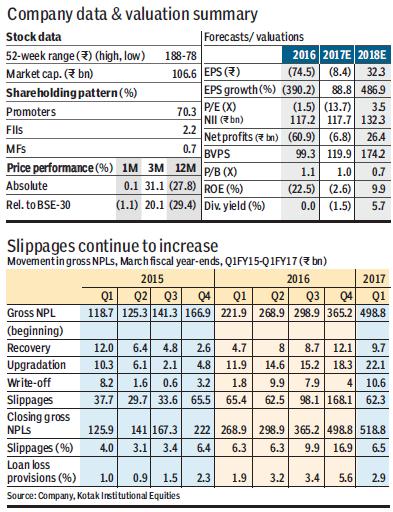

Fresh slippages at 6.5%; total impaired loans stable q-o-q

BOI reported fresh slippages of 6.5%, similar to the run-rate of three quarters leading to the AQR exercise. Nearly 40% of the slippages were from corporate accounts. Around one-fourth of slippages came from restructured loans. Total impaired loans are stable q-o-q at 16.5%, comprising 13.4% gross NPL and 3.1% restructured loans. The bank has done SDR on loans of R21 bn and 5/25 refinancing of R30 bn loan exposure. It has also given SMA1 and SMA2 of around 3.0% and 1.3% respectively. The bank has targeted to keep gross NPL at current levels through greater focus on recoveries and upgrades.

Maintain add; waiting for stability of the balance sheet

We maintain our add rating (TP at R120 from R110 earlier) on the bank despite noting the recent price performance. The bank appears to be showing some initial signs of stability as most key operating metrics are not showing any worsening trends. SMA-2 book is stable though an improvement would have been preferred considering the extent of slippages. The bank should see better growth in operating profits from now considering that operating expenses are likely to see a sharp growth slowdown as one-off expenses relating to change in mortality tables have been completed. This should give additional headroom to improve coverage ratio.

NIM shows marginal improvement; interest reversals lead to yield contraction

Overall NIM reported a 15bps q-o-q improvement at 2.2%, 10 bps q-o-q domestic margin improvement to 2.5% and 20 bps q-o-q increase in international margins. The bank is intending to run-down the low margin buyer’s credit book. Domestic yield on loans declined 70 bps q-o-q to 9.7%, partly explained by interest reversals.

Loan book down 5% y-o-y on net basis; flat on gross basis

Overall loan book declined 5% y-o-y but the gross loan portfolio was flat. Domestic loans declined 2% y-o-y while the international loan portfolio was flat y-o-y. Within domestic, corporate loan fell 8% y-o-y as most of the growth came from retail (13% y-o-y) and agriculture (5% y-o-y). The realignment will see continued decline in overseas book, while the bank targets to grow the domestic loan book at close to 10-12% y-o-y.