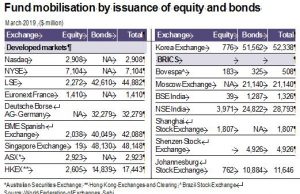

Fundraising by issuance of equity and bonds across major global exchanges was dominated by Korea’s Kospi Exchange at $52,338 million ($52.3 billion) during March. However, among the BRICS nations, India’s National Stock Exchange (NSE) led the pack.

BRICS is an association of five major emerging economies — Brazil, Russia, India, China and South Africa.

During March, NSE raised $3,971 million through equity issuance and $24,822 million through bond issuance, according to data shared by World Federation of Exchanges (WFE). The Bombay Stock Exchange’s (BSE) fund mobilisation was negligible in comparison to NSE, wherein $1,326 million was raised.

The total fund mobilisation by both NSE and BSE via issuance of equity and bonds stood at $30,119 million ($30.1 billion).

After India, Russia and South Africa led the pack with regard to fund mobilisation. Russia’s Moscow Stock Exchange raised $21,140 million and South Africa’s Johannesburg Stock Exchange mobilised $11,646 million in March.

Meanwhile, China’s Shanghai and Shenzen stock exchanges mobilised $1,807 million and $4,926 million, respectively, in the month.

The total funds worth $2.8 billion in equity and debt raised by NSE were higher than the US’s Nasdaq ($2,908 million) , NYSE ($7,104), France’s Euronext ($1,410), Australian Securities Exchange ($2,923) and Hong Kong Exchanges and Clearing ($17,443).

WFE data shared by Sebi clarified that fund mobilisation data for equities are excluding investment funds and including alternative and SME markets.

As on April, annualised volatility of both NSE Nifty50 index and S&P BSE Sensex stood at 10.3% among BRICS.

Brazil’s Ibovespa index and China’s Shenzen index had the highest volatility — at 20.2 % and 20.9%, according to Bloomberg data shared by Sebi.

However, India’s PE ratio still remains the highest at 29.3 (Nifty50) after Nasdaq composite index (33.5).

In its report, the regulator said the emerging market economies continued to grow, but the growth tempo has been slower this year. Though growth in India slowed down in the final quarter of 2018, India has recorded the highest growth among the major emerging markets.

“The Brazilian economy, which is Latin America’s largest economy, has recorded weak recovery in last one year. Analysts have cut their 2019 growth forecasts for the economy in a signal of mounting investor pessimism, while performance of the Chinese markets was also average,” Sebi said in the report shared on Friday.