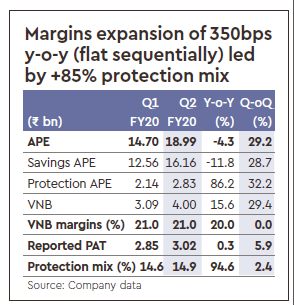

IPRU’s Q2FY20 results were in line with our expectations, with 4% APE contraction (known through monthly trends) and 21% VNB margins (flat y-o-y but up 350bp y-o-y). The key positive was 85% growth in protection, which led to 15% protection mix. The improving protection mix has led to 20% y-o-y growth in VNB despite muted APE trends. The key negative in the results was the ~200bp dip in persistency for the early cohorts.

Stock view

IPRU stock has re-rated to 2.4x Mar-21 EV from 1.9x Mar-21 EV, driven by improving protection mix and VNB margins. This story remains intact. While we factor in muted savings business momentum until FY21F, we do not factor in a further fall in savings business margins. Savings business cost ratios have trended lower y/y and while persistency still remains higher than management’s VNB margin assumptions, any further decline would need to be arrested so as to not impact VNB margins. After the recent re-rating in domestic insurance stocks, we prefer ICICI and Axis Bank among India Financials.

Key 2QFY20 highlights

Protection business momentum remains strong driving VNB growth: While the savings business fell 8% y-o-y in 1HFY20, protection APE was up 85% in Q2FY20/1HFY20. Share of protection APE in total APE increased to ~15% from 9% in FY19. This has led to VNB margins increasing to 21% in 1HFY20 from 17.0% in FY19. VNB grew by 20% in 1HFY20. We factor in 20% CAGR in VNB over FY19-21F.

Savings mix changing: ULIPs APE fell by 23% y-o-y in Q2FY20. We previously flagged that large-ticket ULIP sales have been slow. Our analysis suggested that ULIP sales could be muted in the near term. PAR book was up 33% in 1HFY20 and annuity and non PAR savings products were up 100% y-o-y on a lower base. Share of PAR/Annuity and guaranteed return products thus increased to 16% in 1HFY20 from 11% in FY19.

Material drop in persistency – near-term key monitorable: Persistency for the 13th and 25th month dropped by ~200bps in 5MFY20 vs 5MFY19. Persistency had dropped by 100-150bp in early FY19 and the fall increased further in 1HFY20. While current 13th month persistency of 83.6% remains better than the management’s 82.5% assumption in VNB margins, persistency dropped by 200-250bp from the peak and should be closely monitored.

IPRU’s opex increased by 15% y-o-y in Q2FY20 and ~12% in 1HFY20 leading to overall opex ratios increasing to 16.6% in 1HFY20 from 16.1% in 1HFY19. The positive is that savings business cost ratios declined to 11.0% in 1HFY20 from 12.7% in 1HFY19. Thus, the ULIP business is unlikely to have negative VNB margins impact from rising cost ratios.