We assume coverage on ICICI Lombard GI (ILOM) with a Buy rating & price target of Rs 1,570 as we see it as a key beneficiary of rising penetration that is one-fourth of global. Scope for doubling of health insurance and normalisation of motor business to anchor growth & share gains from PSUs; driving 14% FY20-23 CAGR in premiums & 17% in PAT. Bharti-Axa was expensive purchase but non-cash & offers synergies over 18-24 months.

Long runway for growth: India’s non-life insurance market is under-penetrated with premium/GDP ratio of 0.9% at one-fourth of global level of 3.8%. In fact, globally (even developed markets) are still seeing rise in penetration. Growth has held up despite Covid. GDP growth, rising penetration & new products will aid 12% CAGR in premium over FY20-23. Private insurers to gain share (15% CAGR) from PSUs (7% CAGR) as they leverage latter’s under-capitalisation & need to improve profits.

ICICI Lombard – tactful at capitalising opportunity: ICICI Lombard has a 7% share in premium and has been tactful at balancing growth with profitability. Innovations, network expansion & gain from PSUs have helped. Moreover, better underwriting (lower share in calamity claims), ability to tap opportunities (fire insurance), willingness to withdraw from risky-segments (crop/mass-health) and investment in digital platforms have helped to deliver better profitability.

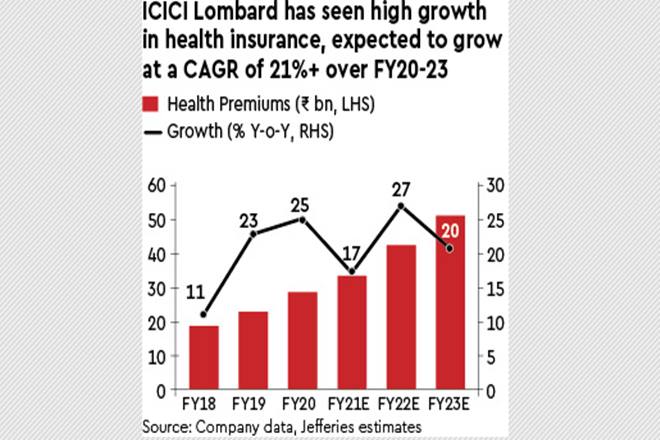

17% CAGR in profit over FY20-23: Two key drivers of growth will be health insurance & normalisation in motor-business. Health insurance can emerge as key growth driver in post Covid-era — penetration can rise and we see market doubling in 5 years. In motor, pick-up has been better than expected. We see scope for Combined Ratio to fall to 98% that will compensate for lower investment income.

Downside and upside: Risks to downside can arise if regulator opens up the health insurance business equally to life insurers (proposal put up). Sharper fall in interest rates/default in fixed-rate investments – so far, zero-default — can be risks. Upside can arise from proper rollout of changes in motor-third-party laws by states – limiting period for claims to 6 months vs. no limit now. This can reduce overall Loss Ratio by 9% points and lift earnings by 8% of annualised PAT, but partly will be passed on as price-cuts.