HPCL’s Q1 EBITDA was 55-57% ahead of our/consensus estimates. Key reason for beat was strong marketing driven by windfall gains in April/May, and higher inventory gain. Near-term outlook is weak. With more lock-down, demand recovery is slower. Refining margins remain very weak. With retail prices of petrol/diesel nearly at peak, OMCs’ ability to raise prices is getting incrementally difficult. We think Q2 could be much weaker.

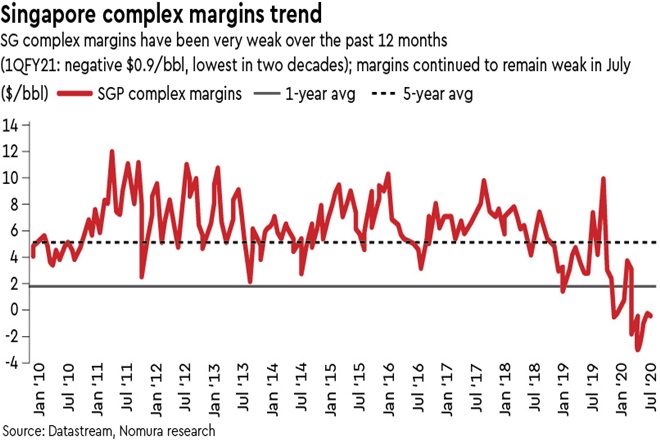

Refining margin very weak; Middle East discounts diminish; volume outlook weak: SG complex margins remain very weak (-0.3$/bbl in July), and the near-term outlook remains subdued. Unlike Q1, OMCs will not benefit from large crude discounts offered by Middle East countries. Continued lockdowns in several states diminish near-term demand recovery and HPCL expects recovery to pre-COVID levels to take a few more months.

Marketing worries us more: After 84 days of no retail price change, OMCs surprised us with Rs 9-11/L hikes on petrol/diesel in June. This ensured that the cost increases were passed on and marketing margins were maintained at normal levels. But we note that at oil prices of just ~$40/bbl (and very low product cracks), petrol/diesel prices are near peak levels, and further hikes are increasingly difficult. While we believe petrol/diesel subsidies will not return, concerns will increase as oil prices/product cracks rise, and retail prices do not rise in tandem.

Raise earnings on lower tax rate: Our FY21F/22F earnings increase by 71%/31%, driven by lower tax rate and inventory gains in Q1. Still we note that FY21F/22F earnings will be lower than FY17-18 levels. We value HPCL’s refinery and marketing segments at unchanged 5x FY22F EV/Ebitda multiples.

Driven by our earnings hike, our TP rises to Rs 215 (from Rs 185), implying 1% upside. We remain Neutral. The stock trades at 0.9x FY22F P/B. While the stock tends to rise on news flow of privatisation of its peer OMCs, in our view, there may not be material re-rating for IOC or HPCL.