Shares of HDFC Bank rose to a life-time high on Friday after the Reserve Bank of India (RBI) removed restrictions on foreign portfolio investors (FPIs) from picking up additional stake in the lender. With the RBI’s order released post market hours on Thursday, shares of the country’s most valuable lender opened over 8% higher with over 4.9 crore shares being traded in just first 30 minutes of trade. Compared to this, the full day average trading volume for HDFC Bank’s shares in the last 20 days is just 69 lakh shares.

However, with the RBI notifying that the 74% foreign investment limit in the bank had been breached within the first few hours of trade, HDFC Bank’s shares came off the day’s high to close 3.5% higher.

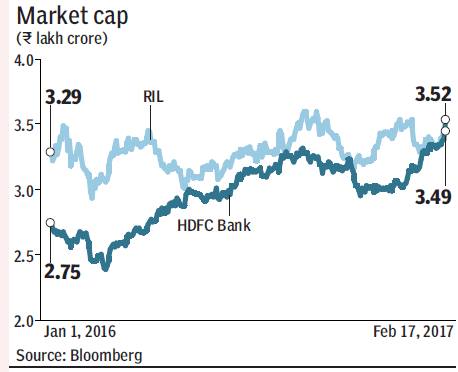

Nevertheless, at Friday’s close, HDFC Bank dislodged Reliance Industries to become the second-most valuable company with a market capitalisation of R3.52 lakh crore. It now trails just Tata Consultancy Services, which has a market capitalisation of R4.74 lakh crore. Such a surge in demand for the shares of HDFC Bank, the world’s most expensive bank if one goes by the price to book value multiple it trades at, is nothing new and foreign investors have often piled in every time the RBI has notified that their investment in the lender had dropped below 74%.

Such demand for the shares of HDFC Bank is also a function of its high rate of growth and the lowest non-performing assets (NPA) ratio among the large lenders in the country. Its gross NPAs stood at 1.05% at the end of December 2016. Compared to this, GNPAs of its rival ICICI Bank stood at 7.91% at the end of the December quarter.

As of Friday, 94.5% of the 55 brokerages that track HDFC Bank have a ‘buy’ recommendation on the shares of the lender.

Analysts at JP Morgan, once such brokerage with a 12-month target price of R1,510, recently noted: “We see HDFC Bank as the best quality play in the current environment, given what we believe are its stable margins, healthy asset quality, consistent performance and superior management. The bank has a strong deposit base – 40%+ CASA ratio with SA growth bouncing back in recent quarters.”