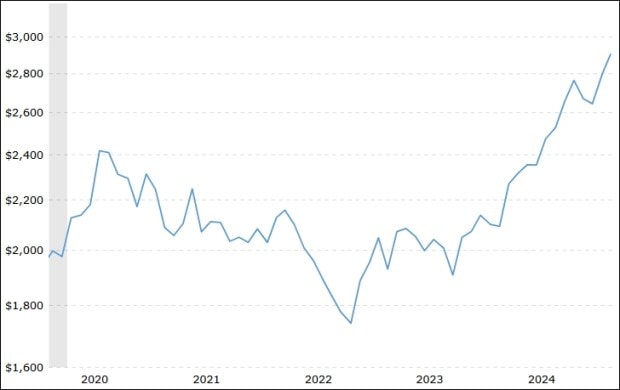

Gold is soaring, posting record highs in almost daily trading sessions. In 2023 and 2024, gold prices continued to rise, with double-digit gains in both years – 13% in 2023 and 27% in 2024. So far in 2025 too, gold continues to shine, with a year-to-date return of nearly 10%.

So, what’s behind this gold rush? You see, the price of Gold typically rises during high inflation, geopolitical uncertainty, or sometimes even an equity market downturn, as observed in the past. Historically, gold has donned the hat as the best hedge against such risks.

Source: Macrotrends ( As of February, 10,2025)

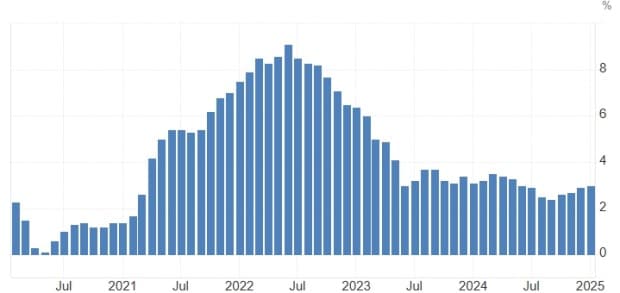

But wait! Gold’s role as an inflation hedge has recently been called into question. Here’s why. Inflation in the United States peaked at 9.1% in June 2022, and when inflation started to fall, gold prices started rising.

Source: Tradingeconomics

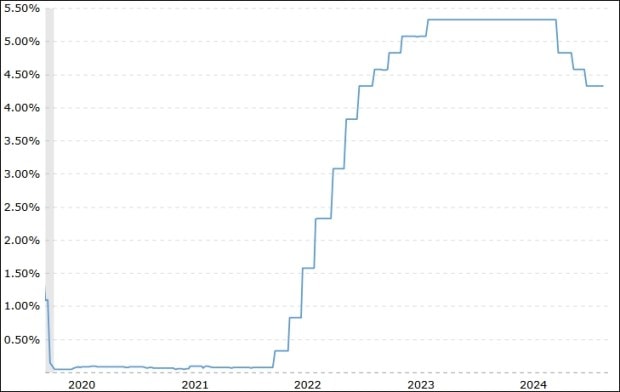

US inflation surged post-Covid, but by calling it ‘transitory’, the US Fed delayed rate hikes until March 2022. The Fed initiated a rate-hike spree after realizing the inflationary pressure and continued to raise rates until July 2023. The rates remained constant until September 2024.

Source: Macrotrends ( February 2025)

But markets knew inflation was trending lower and rate cuts are in the offing. As a result, gold prices began to surge earlier in February 2024.

Back in May 2022, we did a story on why gold is not a preferred asset class in a rising interest rate scenario. Then, we said:

“What is keeping the gold price in check is the interest rate scenario. In the US, the interest rates have started to move up and the Fed is expected to announce a series of rate hikes after the May 2022 hike of 0.5 per cent. In a rising interest rate scenario, gold is not a preferred investment.”

So, it seems geopolitics played a significant role in the gold price, particularly after 2020. In addition to rate cuts, gold prices have surged due to geo-political tensions arising from the Russia-Ukraine war, the Israel-Hamas conflict and the increasing tensions between China and Taiwan

On top of it, the global uncertainty worsened as Donald Trump returned to the White House. Today, Trump’s tariff policies are poised to trigger trade wars, significantly impacting global currencies.

The gold rate today has hit $2,933 per ounce (USD) and Rs 86,810 per 10 grams in India. One gram gold price for 22 kt gold rate today is Rs 7,882. The price of gold per 10 grams is a popular measure for gold prices in India.

Source: Macrotrends ( February 2025)

What has caught the attention of gold enthusiasts in the country is the milestone figure of Rs 85,000 per 10 grams, which it crossed on February 5, 2025. Not long ago, the BSE Sensex — India’s benchmark stock market index — also crossed the 85,000 mark for the first time on September 25, 2024.

BSE Sensex hit an all-time of 85,978 on 27th September 2024 before closing at 85,571, an all-time high closing figure. For the first time, BSE Sensex breached the 85,000 level on 25th September 2024.

With both assets coincidentally hitting the Rs 85,000 mark, let us see how they compare in terms of returns over the past 20 years.

Gold vs. Sensex: 20-Year Growth

In 2005, the Sensex was at 8,000 while Gold was around Rs 7,000 per 10 grams.

In 2025, both gold and Sensex (September 29, 2024) have crossed Rs 85,000.

Despite the four-month gap between the two milestones, a long-term investment view evens out such differences.

Using the Compound Annual Growth Rate (CAGR) formula, both assets have delivered annual returns of 12% to 13% over the last 20 years.

Amazing coincidence right? But there’s a catch, which people often miss.

Key Takeaway

International gold price is denominated in US Dollars and any strength in USD means a weakening in Indian Rupee. Historically, INR has lost value against the USD, so when the Rupee depreciates, the value of gold increases. This adds to the Indian rupee-denominated returns of gold.

To put this in context, the same 20-year return on Gold, in US dollar terms is 10%. The additional return for Indian investors (between 2% and 3% annually) in gold has come from Rupee depreciation.

While gold and stocks are different types of investments, they have provided similar returns over two decades. Whether one is better than the other depends on market conditions, risk appetite, and investment goals. Decent exposure to gold, along with equities and bonds, will provide the required stability to one’s portfolio while mitigating concentration risk.

In short, the name of the game is not gold or stocks. It’s having both in the right proportions as part of your asset allocation.