Walmart isn’t exactly the kind of stock you expect to surge. It’s the dependable, steady player – the place people go to save a few bucks on groceries, not the kind of company that makes Wall Street sit up and take notice.

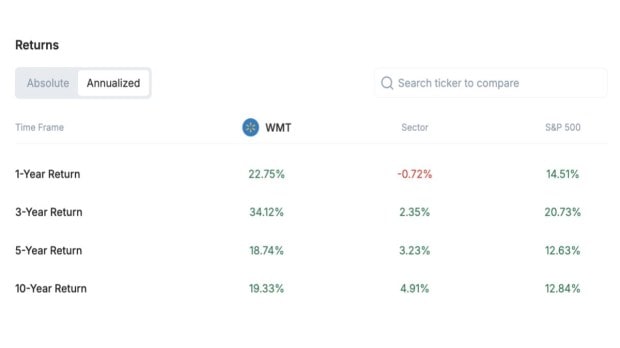

But here we are, closing in on the end of 2025, and Walmart’s share price is up nearly 30% year-to-date. Historically, on an annualised basis, the stock has also outperformed the broader index across multiple time periods. That is simply the reality.

The question now is what’s behind this unexpected run? Is it inflation pushing more shoppers toward Walmart’s value-first shelves? Is it the rise of its online business, now generating over $100 billion in sales? Or is it something else, like a company that’s reinventing itself while everyone’s watching Big Tech?

This piece breaks down what’s really happening at Walmart, what’s changed in its business, and whether this kind of momentum is built to last.

What’s behind the 30% rally: Stronger sales, better margins and smarter execution

Walmart’s nearly 30% stock jump this year didn’t come from a single headline or one-off moment. It’s been building quarter after quarter thanks to steady growth in sales, improving profitability, and focused execution across its core and newer businesses.

Let’s look at the numbers.

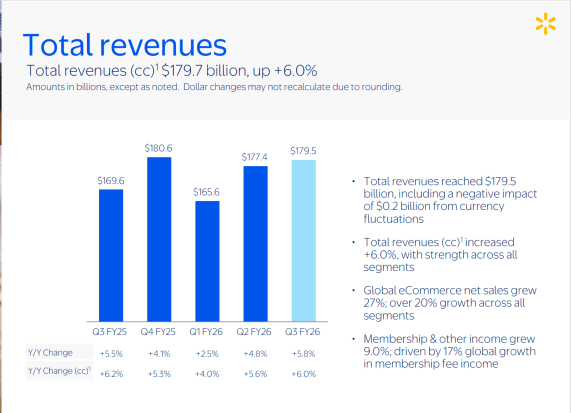

In Q2 FY26, Walmart reported:

- Revenue of $177.4 billion, up 4.8% from the same quarter last year

- Gross profit of $44.6 billion, with margins improving to 24.5%

- Adjusted Operating income of $7.3 billion, but year-over-year growth was relatively flat

Then in Q3 FY26:

- Revenue rose to $179.5 billion, a 5.8% increase

- Gross profit came in at $44.8 billion, with gross margin remained flattened to 24.2%

- Adjusted Operating income was $6.7 billion, with a year-over-year growth of 8%

So not only is Walmart growing revenue, it’s doing a better job keeping more of it as profit. That kind of margin discipline is a big part of why investors are paying attention.

But it’s not just the top and bottom line. The company is moving in the right direction in areas that matter for the future.

- E-commerce is becoming a real growth engine: U.S. e-commerce sales were up 26% in Q2 and 28% in Q3. Walmart has now delivered seven straight quarters of 20%+ growth online. Nearly half of online orders are fulfilled from stores, which cuts delivery times and makes the business more efficient. Management has also confirmed that e-commerce in the U.S. is now profitable – a key milestone.

- Walmart Connect, its ad business, is scaling up fast: Advertising revenue grew 31% in Q2 and 33% in Q3 in the U.S. Globally (including Flipkart and Vizio), it grew 53%. This kind of high-margin income is starting to make a real difference in operating profit.

- Membership income is picking up pace: Membership and other income grew 5.4% in Q2 and 9.0% in Q3, powered by a 17% jump in global membership fees. Walmart+ had its best quarter for new sign-ups since launch. This signals growing loyalty and more recurring revenue.

- Margins are improving, even in a high-cost environment: Despite continued investments in pricing, store automation, and delivery infrastructure, Walmart expanded both gross and operating margins over the last two quarters. This shows it’s not just spending to grow, but it’s growing efficiently.

Put together, these numbers show a company that’s getting the fundamentals right: growing in the right places, holding costs where it can, and building businesses (like ads and memberships) that can carry more weight over time.

For a retailer of Walmart’s size, this level of consistency and operating discipline is what gives investors confidence and why the stock has done what it has.

Why shoppers are choosing Walmart and whether that momentum can hold

Part of Walmart’s stock surge this year is also about how people are shopping. With prices still high across essentials, many consumers are rethinking where they spend. And for more of them, the answer seems to be Walmart.

In the last few quarters, Walmart has seen more middle- and even higher-income households walking through its aisles (or adding to cart online).

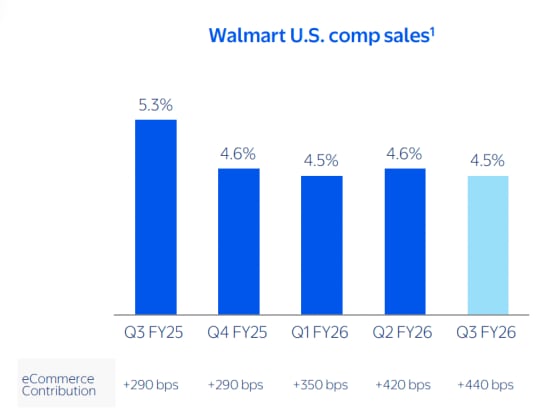

That’s more about people trying to stretch their budgets on groceries, health products, and other staples. And Walmart’s strength in those categories has helped. In Q3, U.S. same-store sales were up 4.9%, driven mostly by food, pharmacy, and everyday essentials.

At the same time, it’s managing to do better in areas that were weak last year, like apparel and seasonal merchandise. This time around, Walmart kept its inventory tighter and pricing sharper. The result: fewer markdowns, better margins, and healthier turnover.

Digital habits are playing a role too.

Online orders, especially pickup and delivery are still growing, with nearly half being fulfilled directly from stores. That helps customers get their orders faster, and helps Walmart keep costs in check. It’s one reason why U.S. e-commerce grew 28% in Q3 and is now profitable.

Add in a bump in Walmart+ sign-ups, the highest since the membership launched, and the retailer is not only gaining traffic, but also building loyalty.

But now that Walmart has raised its full-year guidance, can this run continue?

For now, the signs look good. Management expects total sales to grow around 5% this year, and adjusted operating income to rise between 10% and 11%. That shows confidence not just in holiday sales, but in how the company is balancing growth with efficiency.

The upside is that Walmart’s gains are spread out not just from stores, or just from online, but from ads, memberships, logistics, and global operations too. Those newer businesses like Walmart Connect and Walmart+ may not make headlines every day, but they’re adding meaningful income and giving the company more tools to handle a tough consumer environment.

That said, nothing is guaranteed. If consumers start pulling back more sharply, or if supply costs creep back up, Walmart’s margins could feel the squeeze. And while ad and membership revenue are growing fast, they still need to prove they can scale consistently over time.

Still, for a company of this size, Walmart is doing a lot of things right. It’s growing where it makes sense, investing without overspending, and keeping customers coming back. That’s why its stock is up and why more people are asking if this kind of growth is just a moment, or the start of a longer story.

Author Note

Note: This article relies on data from fund reports, index history, and public disclosures. We have used our own assumptions for analysis and illustrations.

Parth Parikh has over a decade of experience in finance, research, and portfolio strategy. He currently leads Organic Growth and Content at Vested Finance, where he drives investor education, community building, and multi-channel content initiatives across global investing products such as US Stocks and ETFs, Global Funds, Private Markets, and Managed Portfolios.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.