Picture this. It’s April 2025, and Tesla’s stock has crashed over 50% from its December 2024 peak. Investors are panicking. Elon Musk is spending more time in Washington than in boardrooms. Car sales are tanking. Tariffs are looming. The dream is dying.

Fast forward to December, and Tesla hits an all-time high of nearly $490 per share. A stunning 121% rally from the April low.

What changed?

Well, two words: Robotaxis and Robots.

The Story

Here’s the thing about Tesla. It’s not really a car company anymore. At least, that’s not what investors are betting on.

Sure, Tesla still makes electric vehicles. But its core auto business? It’s struggling. Sales are inconsistent. Growth is tepid. The operating margin is a measly 5.1%. Competition from Chinese EV makers is brutal.

So investors have moved on to the next big thing: autonomous vehicles.

Think about it like this. Imagine you own a pizza shop, but pizza sales are flat. Then you discover you could use your kitchen to run a cloud cooking service for restaurants worldwide. Suddenly, you’re not just selling pizzas, you’re selling infrastructure. That’s essentially what Tesla is trying to do with robotaxis.

Here’s the plan: Tesla will start Cybercab production in April 2026. These are fully autonomous robotaxis, no steering wheel, no pedals, just AI doing all the driving. The company wants to produce 3 million of these vehicles within 24 months.

And here’s where it gets interesting.

The Economics

Tesla claims its robotaxis will cost just $0.20-$0.40 per mile to operate. Compare that to Waymo, which charges passengers around $1.66 per mile in San Francisco (the Waymo pricing is dynamic and could vary, but you get the picture). Even if Tesla charges customers $0.50 per mile, the margins are mouth-watering.

How are they pulling this off?

By ditching expensive LiDAR and radar systems that competitors use. Instead, Tesla is betting everything on AI chips and cameras. It’s like choosing to navigate using Google Maps on your phone instead of buying a $10,000 professional GPS system. Risky? Maybe. But if it works, the cost advantage is massive.

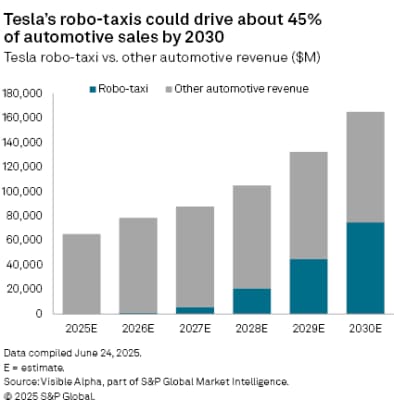

Conservative estimates suggest robotaxis could generate $54 billion in annual revenue by 2030. That’s more than half of what Tesla makes today from selling actual cars.

Source: S&P Global

Some analysts think it could hit $75 billion.

But Wait…

Before you rush to buy Tesla stock, let’s pump the brakes.

First, Tesla is late to the party. Waymo and Zoox are already running commercial robotaxi services. They’ve got the head start, the data, and the regulatory approvals. Tesla is playing catch-up.

Second, Elon Musk has a track record of overpromising. He’s been saying full self-driving is “coming next year” since 2015. The Cybertruck was delayed by two years. Timelines slip. A lot.

Third, the valuation is absolutely bonkers. Some analysts are calling Tesla overvalued and slapping a $330 price target on it—a potential 30% drop from current levels. The company trades at multiples that assume everything goes perfectly. If robotaxis stumble, the stock could crater.

The Bigger Picture

But here’s what makes this fascinating. Tesla isn’t just betting on robotaxis. There’s also Optimus, the humanoid robot that Musk wants to produce at 1 million units per year. Priced at $20,000-$30,000 each, that’s another $24 billion in potential revenue by 2030.

Add it all up—robotaxis and robots—and you’re looking at $78 billion in new revenue streams. That would fundamentally transform Tesla from a car company into an AI and robotics company.

The energy storage business is also booming, up 44% year-over-year. Free cash flow hit nearly $4 billion in Q3. So it’s not like the core business is collapsing.

The Bottom Line

Can robotaxis save Tesla?

Maybe. If Tesla executes flawlessly, delivers on its cost advantages, and captures meaningful market share, then yes—robotaxis could be the catalyst that propels Tesla into a multi-trillion dollar valuation.

But if development drags on, competitors consolidate their lead, or regulators throw up roadblocks, then Tesla could be stuck with an expensive R&D bill and not much to show for it.

Right now, investors are betting on Musk’s vision. Again.

History suggests caution. But then again, betting against Elon Musk hasn’t exactly been a winning strategy over the long run.

So, will robotaxis save Tesla? Ask us again in 2026.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

(Sonia Boolchandani is a seasoned financial writer She has written for prominent firms like Vested Finance, and Finology, where she has crafted content that simplifies complex financial concepts for diverse audiences.)

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.