Everyone spent 2025 obsessing over Nvidia. AI chips, data centers, trillion-dollar valuations. You know the drill. Meanwhile, Robinhood Markets was quietly putting together one of the most spectacular rallies of the year. The stock tripled. Up 207%. That’s not a typo.

To put this in perspective: Nvidia, the darling of Wall Street, gained around 30% in 2025. Robinhood crushed it by 7x. And it wasn’t just beating Nvidia. It demolished Charles Schwab (up 34%) and became one of the top performers in the entire S&P 500.

So what happened? How did a retail brokerage app outperform the AI revolution?

The Retail Army Returns

Remember the meme stock madness of 2021? GameStop, AMC, diamond hands, and “apes together strong”? Well, retail traders are back, and they’re bigger than ever.

In Q3 2025, retail investors accounted for over 20% of US equity trading volume. That’s the highest level since the 2021 chaos and nearly double their market share from a decade ago. These aren’t just casual investors dabbling in stocks. They’re active, engaged, and trading aggressively.

And guess which platform they’re using? Robinhood.

The company added 2.5 million funded customers over the past year, bringing the total to 26.8 million. Its paid Gold subscription service exploded. Up 77% to 3.88 million subscribers. People aren’t just opening accounts. They’re paying for premium features.

The Crypto Comeback

Here’s where things get interesting. While traditional brokerages tiptoed around crypto, Robinhood went all in. And it paid off massively.

The Trump presidency brought renewed optimism around crypto regulation. Bitcoin rallied. Altcoins followed. And Robinhood’s crypto-friendly platform became the go-to destination for retail traders wanting exposure.

The numbers tell the story: assets under management hit $333 billion. Up 119% year-over-year. Net deposits more than doubled to $20.4 billion. This wasn’t just existing users trading more. New money was pouring in.

The Fundamentals Actually Worked

This wasn’t a meme stock rally driven by Reddit hype. Robinhood’s business exploded:

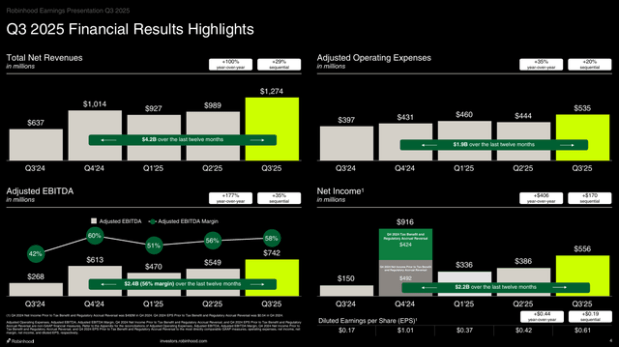

- Revenue doubled to $1.27 billion (100% YoY growth)

- Earnings per share jumped 3.6x to $0.61

- Net income tripled to $556 million

- Operating expenses grew only 35% while revenue doubled

That last point is crucial. Robinhood proved it could scale profitably. Gross margins hit 92%. Far above the 60% sector median. Net margins reached 52% versus 24% for peers.

The company wasn’t just growing. It was printing money.

The Market Didn’t Care

Here’s the twist: when Robinhood reported these blockbuster Q3 results, the stock dropped 11% the next day.

Why? Because at a certain point, perfection gets priced in. The stock was already trading at 51x forward earnings—4.4x higher than sector peers. Even spectacular results couldn’t justify further gains.

This is the danger of momentum stocks. Robinhood delivered everything investors could want: triple-digit revenue growth, margin expansion, customer acquisition, profitable operations. And the market shrugged.

The Valuation Problem

At 207% gains and a $109 billion market cap, Robinhood now trades at nosebleed levels. The forward price-to-sales ratio sits at 23.82—over 7x the sector median of 3.13.

For context: the market is assuming Robinhood will continue growing revenue at 75%+ annually while expanding margins and adding millions of customers. Any stumble (a crypto crash, reduced retail trading activity, increased competition) could trigger a sharp correction.

Some analysts are calling for a 33% decline from current levels. Their argument? The rally has run too far, too fast. Even great companies can become overvalued.

The Retail Shareholder Wildcard

But here’s what makes Robinhood different: retail investors own 31% of the company. These aren’t hedge funds looking to flip shares. They’re users who believe in the platform because they use it daily.

This creates a natural support level. When institutional investors sell, retail buyers step in. It’s why Robinhood has maintained its gains even as analysts turn cautious.

What Happens Next?

Robinhood is pushing into new territory. Private AI investments, global expansion, prediction markets. These bets could unlock new revenue streams or become expensive distractions.

The company also faces macro headwinds. The S&P 500 is on track for its third straight year of 20%+ gains. Bull markets don’t last forever. When volatility returns and risk appetite fades, active trading declines. That’s bad news for Robinhood’s business model.

Wall Street expects $2.36 in earnings per share for 2026. At current valuations, meeting that target won’t be enough. The stock needs to beat expectations—repeatedly.

The Bottom Line

Robinhood delivered one of 2025’s most impressive performances. The 207% gain wasn’t luck. It was backed by explosive business growth, margin expansion, and perfect timing on the crypto rebound.

But at these levels, new buyers are chasing a rally that may have already priced in the good news. Sometimes the best trade is the one you don’t make.

The smart money made 207% this year. The question is: can they make it again in 2026?

(Sonia Boolchandani is a seasoned financial writer She has written for prominent firms like Vested Finance, and Finology, where she has crafted content that simplifies complex financial concepts for diverse audiences)

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.