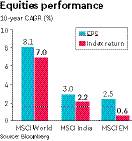

With benchmark indices continuing to surge without much earnings support from most companies, India is the most expensive market relative to others around the world. However, returns, since the global financial crisis broke in 2008, don’t justify India’s sky-high valuations as India has underperformed MSCI World Index over this period. Since the global financial crisis broke in 2008, India has delivered 2.2% compounded annual growth rate (CAGR) over 7% MSCI World’s returns in the same period.

Returns have been in line with earnings. The earnings per share (EPS) growth of MSCI World Index clocked a CAGR of 8.09% between 2010 and 2019, EPS of MSCI India Index grew at 3.02% in dollar terms during the same period. The MSCI Emerging Markets Index, where India is a subset, grew by just 2.5% in the last 10 years, Bloomberg data showed.

Even as the Nifty50 gained nearly 9% during 2010-2019, deprecation in the rupee has made the dollar return for the index unimpressive to just 4.2%. The local currency has come off by 4.1% at an annualised rate since 2010. The weakness in rupee has been a very significant factor for overseas investors to put their money in Indian market as the erosion in the local currency would inversely affect their returns.

Nevertheless, India remains one of the most expensive markets in the world. At its close of 11,937.50 on Monday, the Nifty50 now trades at a price-earnings (P/E) multiple of 18.1 times to the estimated one-year forward earnings, as compared to its 10-year average of 15.5x. On valuations, it is closer to its previous peaks of 19x. This compares with 11.4 times for Kospi and 14.5 for Jakarta Composite, Bloomberg data showed.

Gautam Chhaochharia, head of India Research, UBS Securities, observed, “At a fundamental level, the valuation of India reflects hopes for medium- to long-term growth. In between periods, where that hopes took a knocking, like a few month back, multiples derated. Whenever that hopes get dashed, multiples have been derated, today that hopes are coming back so as increase in multiples.”

The net profit for a sample of 2,597 companies collapsed by 21.6% to Rs 1.67 lakh crore for the first half of FY20, data sourced from Capitaline revealed.

Analysts have upped their Nifty50 target for 2020 by about 7-10% from this year’s peak, as they expect there would be a gradual recovery in economy and strong fund flows into the Indian equity market, going forward. However, they pointed out that there is a significant disconnect between economic growth and stock valuation because of corporate rate cut and resurgence in fund flows. Next year, being an US election year, there is an increased chance of higher inflows in the second half 2020, experts observed.

Jaideep Hansraj, managing director & chief executive of Kotak Securities, is of the view that market mood is more positive than what is reflected in the real economy, mainly because of improvement in earnings led by a reduction in corporate tax rate and strong FPI & SIP flows.

“The disconnect between equity markets and economy could stay for some time as high-frequency indicators are not showing any signs of improvement whereas markets could remain at elevated levels on hopes of certain sops likely to come in the forthcoming Union Budget,” Hansraj added.

This calendar year to date overseas investors along with local institutional investors have pumped in about $20 billion in Indian equities, helping Nifty50 to deliver a return of nearly 10%. Monthly SIP flows into mutual funds have been over Rs 8,000 crore during the year providing cushion to the market.