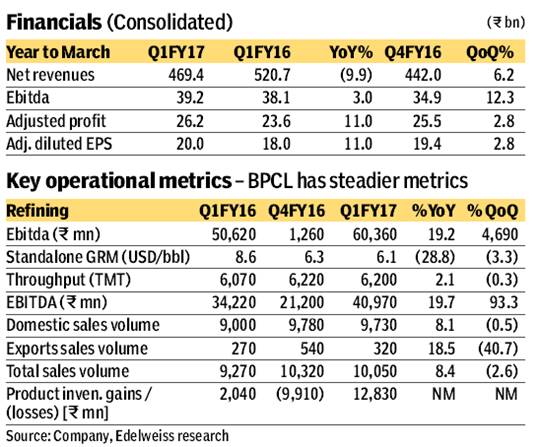

Bharat Petroleum Corporation Ltd (BPCL) reported in-line Q1FY17 performance with profit of Rs 26 bn (up 3% q-o-q, 11% y-o-y). While overall GRM, at $6.1/bbl ($ 6.3/bbl in Q4FY16, $8.6/bbl in Q1FY16), was lower than peers due to lower inventory gains, core GRM was ahead ($4.5/bbl versus IOCL/HPCL $3-4/bbl). We expect GRM to remain subdued in near term (Q2FY17: $ 5/bbl) as: QTD Singapore GRM is down 12% q-o-q; and range-bound oil price will limit inventory gains. However, diesel retail margins have surged 33% QTD. On structurally higher GRMs post Kochi expansion, we raise our target price to Rs 715 (Rs 667 earlier). Maintain buy.

In-line refining performance

GRM of $6.1/bbl (down 3% q-o-q, 29% y-o-y) came in line with our estimate of $6.0/bbl. Management highlighted inventory gain of ~$1/bbl, implying core GRM of $5/bbl. Throughput, at 6.2MMT, also came in line.

Bina and Numaligarh report robust performance

Bina and Numaligarh reported strong GRMs. Bina reported GRM of $14.5/bbl with overall PAT of Rs 3.6 billion, while Numaligarh reported GRM of $9.05/bbl with overall PAT of R5 billion.

Outlook and valuations: best of the lot; maintain buy

We expect a subdued Q2FY17 given that QTD Singapore benchmark GRM is down 12%. However, commissioning of the high-margin 6MMT Kochi refinery expansion by end of the year will structurally enhance refining margin. The company will undertake significant capex of Rs 1 trillion across verticals, which will drive long term earnings. We forecast 19%/11% EPS growth in FY17/18. The stock currently trades at an attractive 7x FY18E PER with RoE in excess of 29%. We maintain buy/so with a target price of Rs 715.

Q1FY17 con-call takeaways

GRM guidance: Given the trend of Singapore margins, management guided for a more subdued Q2FY17 with GRM of $5-6/bbl.

Kochi expansion: Management guided for Q4FY17 as the first quarter of full commissioning and expects to achieve 70% utilisation in the first year of operation. Post expansion, BPCL will earn $2/bbl higher GRMs from its earlier benchmark.

Capex guidance: Management guided for FY17 capex of Rs 130 billion. Of this, R50 billion is earmarked for Kochi.

Mozambique: Management stated final agreement with Mozambique is yet to be signed. They now expect the FID by mid-2017 and investments to commence immediately thereafter.

Brazil: Appraisal is under way and should be completed by end of the year. Approvals should commence in FY17.

Russian acquisitions: BPCL has signed the HoS and final due diligence is under way. Both fields are producing and therefore revenue will start accruing once acquisitions are finalised.