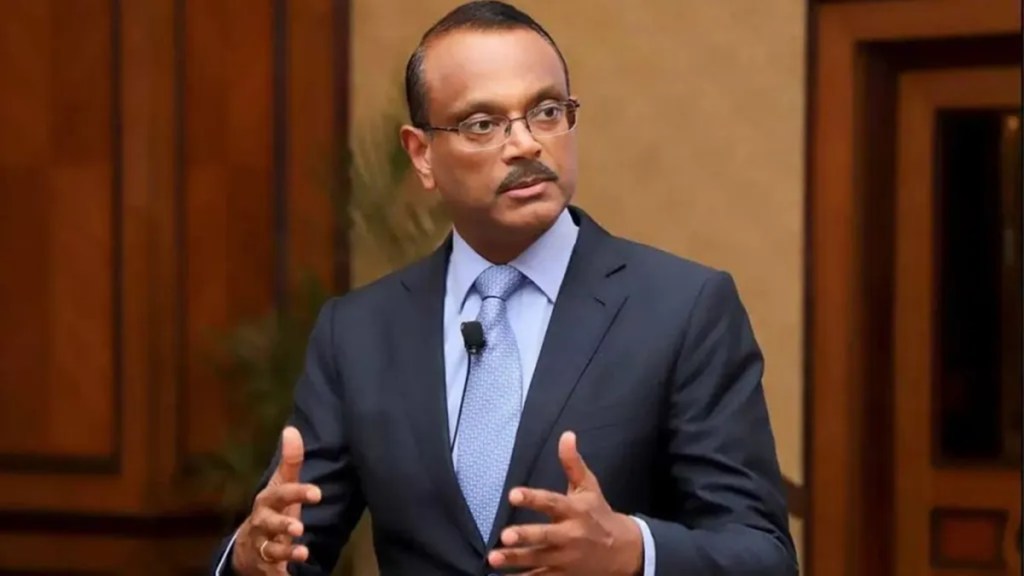

In a remarkable development, domestic investors (DIs) have put in over Rs 18 lakh crores ($210 billion), between April 2019 and June 2025 — more than seven times the net inflows of $29 billion from foreign portfolio investors (FPIs), said Ananth Narayan G, the whole-time-member of Securities and Exchanges Board of India (SEBI).

Speaking at the International Conference on Financial Planning, he mentioned inflows have transformed the markets’ landscape. “The opportunities and challenges this trend brings and the need for informed, responsible investing, the crucial role of registered financial planners in this journey, and what SEBI is doing to support these objectives are notable,” he said.

Retail participation

At the same time, unique investors in India are up from 4.2 crores in March 2020 to 13 crores today. “An impressive number, yet there is plenty of room to grow. We must ensure that trust is maintained in the ecosystem; trust that can be challenged by market manipulation. Here, first-line regulators, our exchanges and depositories, along with SEBI and all other stakeholders, have a crucial role to play,” Narayan said.

Last fiscal, domestic savers contributed a record Rs 6.1 lakh crores into equity-risk oriented mutual fund-schemes. “This strong and steady demand for risk enabled our corporates to raise an unprecedented Rs 4.6 lakh crores in the equity primary markets through initial public offers (IPOs), follow-on (FPOs), rights issues, preferential allotments, and qualified placements (QIPs),” he said.

Returns, AIF growth

He added that in capital markets, nothing personifies success better than the combination of robust demand and record supply of risk-paper. It is also heartening that domestic investors into risk-oriented mutual funds collectively earned 15.5% annualized return over the past six years.

“FPIs remain a crucial and welcome stakeholder in our markets. As of June-end, FPI assets under custody in our equity markets stood at over Rs 74 lakh crores, or well over $860 billion. FPIs contributed to India’s capital formation. They too have benefitted handsomely, with annualised total returns of over 10% in $-terms since they started 30 years ago,” Narayan said.

Alternate Investment Funds (AIFs), which channel affluent, risk-capable capital largely into the unlisted space, have witnessed significant growth. As of March 2025, commitments into AIFs stood at Rs 13.5 lakh crores, a growth of over Rs 1.7 lakh crores in just one year. In the past five years, AIF commitments have compounded annually at 30%.