Why should the U.S. Federal Reserve’s decisions matter to an Indian investor who only buys gold?

At first glance, it may seem that the U.S. Federal Reserve (the Fed) only affects American equities and bond markets. But because the U.S. dollar remains the world’s reserve currency and gold is traded globally in dollars, any change in U.S. interest rates ripples across international markets, including India’s gold market. As of 2025, the total value of above-ground gold is estimated at roughly $25 trillion, calculated by multiplying the global gold stock (about 210,000 tons) by its market price(4000$). Gold has been humanity’s store of value across civilizations, later replaced by paper money as official currency. In a previous article, we discussed how paper money displaced gold as the global medium of exchange and why people still turn to gold in times of uncertainty.

From the Gold Standard to the Dollar Standard

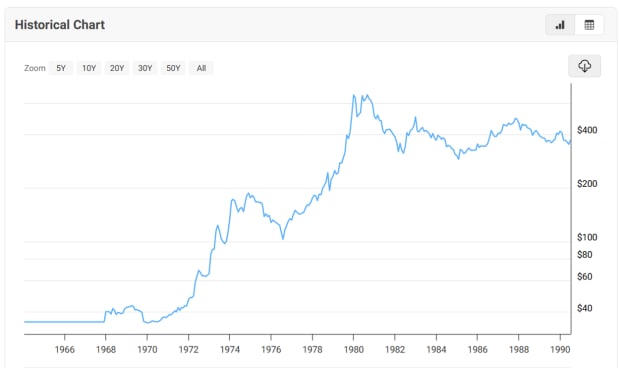

For centuries, governments issued gold as money or paper money backed by gold. After World War II, the Bretton Woods system made the U.S. dollar the anchor of global trade: foreign central banks could exchange dollars for gold at a fixed price of $35 per ounce. But U.S. government spending on wars and welfare programs eroded this system. In 1933, President Roosevelt ended domestic convertibility of dollars into gold. By 1971, President Nixon suspended international convertibility, an event known as the Nixon Shock and by 1973, currencies floated freely against one another, ending the gold standard and cementing the U.S. dollar as a fiat reserve currency. After these shifts, gold prices surged, from $35 per ounce in the early 1970s to nearly $750 per ounce by 1980: driven by inflation, the oil embargo, and the Vietnam War’s costs.

Below is the price of gold after the Nixon Shock and Oil Embargo of the 70s

Why Interest Rates Affect Gold

Gold does not pay interest or dividends. This makes U.S. interest rates crucial in determining its appeal. When rates fall the opportunity cost of holding gold declines, and a weaker dollar plus higher inflation expectations make gold more attractive. When rates rise, bonds and deposits become more rewarding, reducing gold’s appeal. This relationship explains why Indian gold buyers, though not directly investing in U.S. bonds, still feel the Fed’s influence. Because gold is priced globally in dollars, any major move by the Fed changes gold’s international price, which then flows into India through imports. For example, in 2025 the Fed cut the federal funds rate to 4.00–4.25%, down from over 5% earlier. This lowered borrowing costs, weakened the dollar, and added upward pressure to gold prices worldwide. Federal Funds rate is the main policy interest rate, which is the rate at which banks lend reserve balances to other banks overnight on an uncollateralized basis. The FOMC determines the target range for this rate to influence monetary policy. Discount Rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank’s lending facility. The Board of Governors sets the discount rate. The federal funds rate is the Fed’s most important tool for influencing the broader economy. Changes in the federal funds rate affect short-term borrowing costs throughout the economy, impacting everything from mortgage rates to interest earned on savings accounts. The discount rate serves as a backstop liquidity tool for banks.

U.S. Debt, Money Printing, and Gold

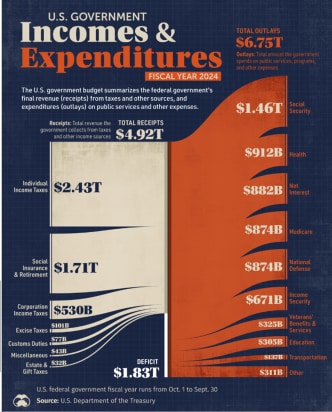

The U.S. currently faces a National debt close to $40 trillion, an Annual deficit nearly $2 trillion and Interest expense approaching $1 trillion per year.

Any government has income(mostly taxes) and expenses. When they have more expenses than income, to finance these gaps, the government issues bonds. When deficits grow too large, it risks either raising interest rates (making debt expensive) or keeping rates low and expanding the money supply (raising inflation). Gold benefits most from the second scenario.

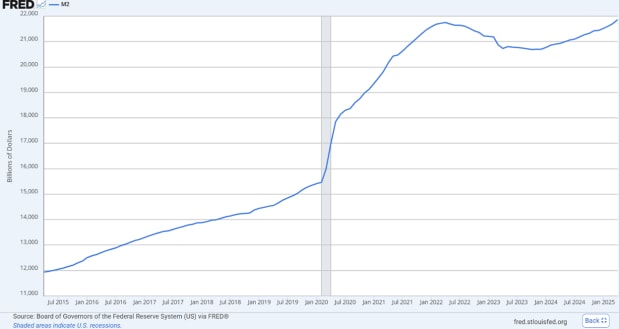

The M2 money supply, which measures cash plus savings deposits, is a key indicator of gold prices in future. Historically, whenever M2 grows rapidly, gold prices tend to rise. Between 2019 and 2025, for instance, M2 surged with pandemic-era stimulus, while gold climbed from about $1,500 per ounce to nearly $4,000.

Every time M2 increases, gold prices increase in history. When interest rates are low, US pays less in interest rates but money printing brings in high chance of inflation. When interest rates are high and less printing of money happens gold prices go down.

Central Banks and Gold Reserves

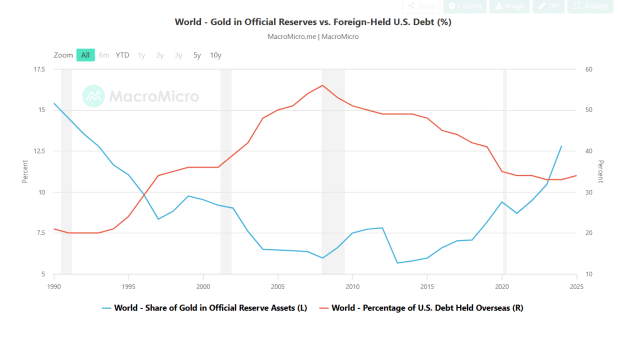

Central banks do not just manage their nation’s money supply; they also act as custodians of financial stability, and one of the ways they do this is by holding reserves in safe, globally trusted assets. Traditionally, this reserve mix has included U.S. Treasuries because of their deep liquidity, creditworthiness, and role as the world’s benchmark risk-free asset and gold, prized as a store of value across centuries. U.S. Treasuries provide liquidity, predictable yields, and are easily tradable in global markets. They serve as a buffer for central banks in times of crisis, allowing them to raise dollars quickly to stabilize their currencies or fund imports. Gold unlike bonds pays no yield, but it acts as an inflation hedge, a safe-haven asset during geopolitical shocks, and a long-term store of value independent of any government’s promises.

Major Holders of Gold

United States roughly around 8,100 tons, the largest official gold reserve in the world, stored mainly at the Federal Reserve Bank of New York. Germany around 3,300 tons, repatriated a significant portion of its reserves from New York and Paris in recent years, signaling the importance of sovereignty over gold holdings. India almost 850 tons, steadily increasing its reserves as gold plays a cultural as well as financial role, reinforcing household demand and bolstering national reserves. Other notable accumulators include Russia (2,300+ tons) and China (2,200+ tons officially, though analysts suspect the true figure is higher due to unreported state purchases).

A Shift in Reserve Strategy

For the first time since 1996, as of 2025 central banks collectively hold more gold than U.S. Treasuries. This marks a historic turning point in the architecture of global finance. The shift reflects waning trust in the U.S. dollar as the undisputed reserve currency.

The usage of any money relies on trust of the underlying. In the case of US dollar it is the trust in the US government. The U.S. and allies froze Russian central bank assets held in dollars and euros after the invasion of Ukraine. This weaponization of reserves shocked many governments, demonstrating that dollar assets are not risk-free if geopolitical tensions arise. By cutting Russian banks off from SWIFT, the global payment systems, the U.S. showed that it could use financial infrastructure as a tool of statecraft. Many nations, even allies, began questioning the security of being overexposed to the dollar system. As a result, countries like Russia and China have accelerated their diversification strategies. Russia has been a steady seller of U.S. Treasuries since 2014 (after sanctions following the annexation of Crimea) and has built up its gold reserves to reduce reliance on dollar assets. China, while still holding over $800 billion in U.S. Treasuries, Beijing has quietly expanded gold purchases as part of its strategy to internationalize the yuan and hedge against dollar hegemony.

The Risks of Relying on Gold

Gold is not risk-free. Its history shows long cycles of boom and bust driven by monetary policy, inflation, and investor sentiment. If the Fed sharply raises interest rates, gold prices can collapse, sometimes for decades. The best example is the 1980s to 1990s. After peaking near $750 per ounce in January 1980, gold entered a prolonged bear market. The spike in 1980 was fueled by runaway U.S. inflation (over 13% at the time), the oil shocks of the 1970s, and geopolitical crises such as the Iranian Revolution and Soviet invasion of Afghanistan. Investors rushed into gold as a hedge against the collapsing dollar.

But when Paul Volcker, then Chairman of the Federal Reserve, raised interest rates aggressively, pushing the federal funds rate above 19% in 1981, inflation was crushed, the dollar regained strength, and gold lost its luster. As real (inflation-adjusted) interest rates turned positive, holding non-yielding gold became far less attractive compared to U.S. bonds.

The result was devastating for gold investors. Its price fell from $850 in 1980 to below $250 by 1982. Through the rest of the 1980s and 1990s, gold mostly traded between $250 and $400, never regaining its 1980 highs. Adjusted for inflation, gold lost over 70% of its value and did not surpass its 1980 peak until 2007, a full 27 years later. This period became known as the “lost decades for gold.” Investors who bought at the peak faced a generation of negative real returns, while U.S. stocks and bonds delivered strong gains.

For central banks and sovereign wealth funds, this history is a cautionary tale. While gold is a powerful hedge against inflation and currency risk, it is highly sensitive to U.S. interest rate cycles. A shift to tight monetary policy, like in the Volcker era, can trigger severe downside in gold and leave reserves underperforming for decades. That is why central banks today continue to hold a mix of U.S. Treasuries and gold reserves—balancing liquidity, yield, and long-term store of value. Overreliance on gold can expose them to decades-long drawdowns when the global monetary tide turns against it.

Why It Matters for India

India is one of the world’s largest consumers of gold, with households holding an estimated 25,000 tons. Because gold is dollar-priced, Fed decisions immediately influence the price an Indian pays at a local jeweler. A rate cut in Washington can push up wedding season gold prices in Delhi or Chennai. Thus, even for Indians who never buy U.S. stocks or bonds, the U.S. Federal Reserve’s actions are unavoidable. Gold may be timeless, but in today’s global economy, its value is tethered to the policies of the world’s most powerful central bank.

How does the gold price return compare with Bitcoin price returns?

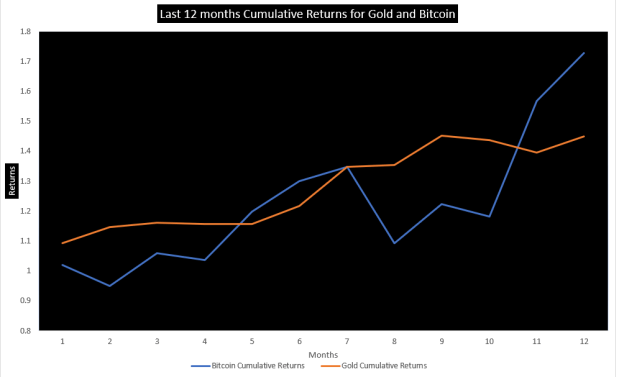

Let us look at the prices of gold and bitcoin in tabular form for the last one year.

Now let us check the cumulative returns monthly for a year for gold and bitcoin

What we can notice is how bitcoin outpaces the returns of gold over time. If governments have decided to increase their gold holdings, what should common investors do? Should ordinary investors also increase gold in their portfolio or add bitcoin into portfolio based on studies and past data? Who should investors believe, the US Fed, Indian central bank or the market and how it talks to us? This is why ordinary investors need to read more and do their homework on all these assets before making such decisions.

Nithin Eapen is a technologist and entrepreneur with a deep passion for finance, cryptocurrencies, prediction markets and technology. You can write to him at neapen@gmail.com

Disclaimer – The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.