ARBP announced that the US FDA has now rescinded the VAI issued to its Unit-IV sterile manufacturing facility within three days of its issuance, and has indicated that the Nov’19 inspection is still open, with the status under review. The development is unprecedented, given that the rescindment was virtually within three days of the VAI grant, and we go back to our base assumption of an OAI status for Unit-IV. We expect the stock to react sharply, particularly given the 20% stock price rally on the back of the VAI announcement.

US FDA does an about turn

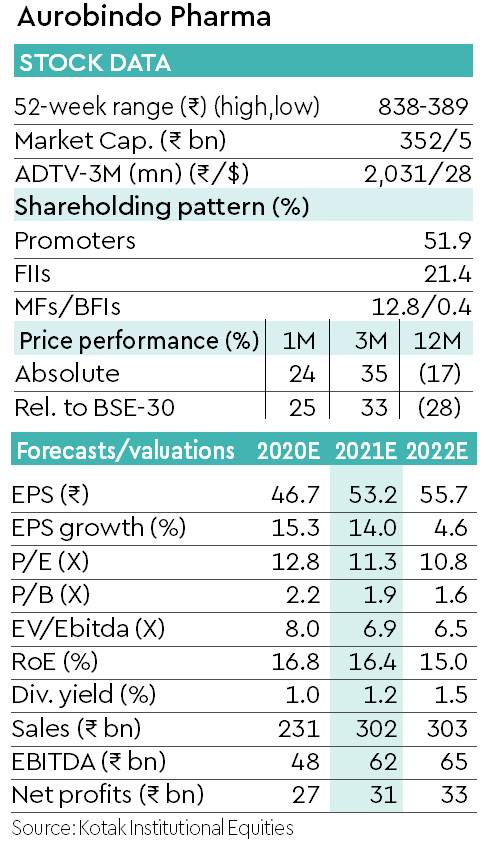

ARBP announced that it has received a follow-up communication from the US FDA, wherein the agency has rescinded the VAI status accorded to Unit-IV on February 18. Given this development, we believe there is now a high risk of an OAI for Unit-IV, which anyway was our base case assumption before the US FDA rescinded its VAI for the facility. Unit-IV is ARBP’s key sterile facility, expected to account for ~$170 mn or ~10% of FY2020e sales, and has the largest number of filings pending approval for ARBP at 47 ANDAs (of total 153 pending ANDAs, of which 15 are expected to be launched in FY2021). Our estimates already assumed clearance for Unit-IV; the rescindment of the VAI status for Unit-IV now places our $280-mn and $343-mn revenue forecasts for the sterile business in FY2021/22 at risk with potential for ~20% haircut on injectable revenues in FY2021/22 (10% of FY2021/22e EPS)., should the issue escalate to an OAI/WL.

Sandoz deal now even more critical

We expect the Sandoz acquisition to close in Mar 2020, and see the evolution of Sandoz portfolio and pipeline as a key sensitivity for ARBP, with the acquisition also adding three facilities, potentially helping ARBP diversify its manufacturing network (or gain synergies). Sandoz’s top-10 products accounted for ~40% of sales in the oral solids bucket including one >$100-mn product (levothyroxine); three US$50-60 mn products; and several products in the $15-20 mn bucket. We continue to expect sharper erosion in the $50-60 mn bucket, explaining the expected drop in oral solids from $750 mn in CY2017 to an expected $560 mn, with topicals also likely to decline to $235 mn by FY2021.

Brace for volatility

We again move our fair value back to Rs 540 (versus Rs 620) to take into account potential risks of an OAI/WL, and expect a sharp correction in stock price given the 20% move post the VAI announcement.