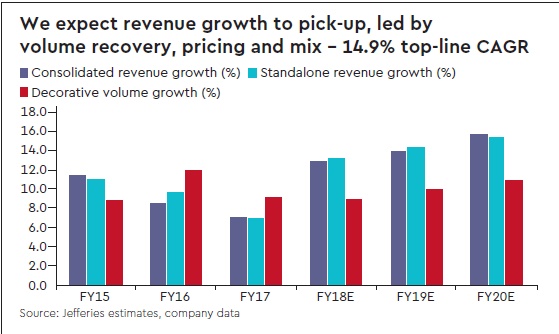

We like APNT for its leading position in decorative paints and focus on driving volumes and penetration, resulting in market share gains over the years. We believe top-line growth will return to mid-teens, driven by ~11% volume CAGR and 4% pricing CAGR over FY18-20E. Margins should stabilise, helped by operating leverage post fall in FY18. We expect EPS to grow 17% CAGR over FY18-20E post 7.5% EPS CAGR over FY16-18. Initiate at Buy, Dec 18E PT of Rs 1,300.

Volume-led growth to continue

Growth in the past decade was led by lower penetration and a sharp fall in repainting cycle, which is now slowing down. We believe APNT can still grow volumes by 10% CAGR over the next 5-10 years, helped by growth in ‘pucca’ houses, repainting cycle trending down and steady market share gain from the unorganised sector.

Pricing and mix to aid topline

Compared with the FY15-17E decline in pricing, inflationary environment is back and hence we expect APNT to take 4-5% price hikes p.a. In addition, benefit of premiumisation will reflect better at the company level, as the pace of entry-level volumes slow down (past eight-year company’s avg. realisation hasn’t grown ahead of price hikes despite premiumisation on like-to-like basis due to penetration-led growth at mass end).

Competitive intensity and market share

Competitive intensity remains high in decorative paints, with Kansai stepping up aggression and Berger also executing well over the years. However, we believe APNT is well positioned to maintain or marginally grow its value market share given a complete product portfolio, distribution strength and a mindset to invest back (it has reinvested more than 50% of 800 bps GM gain in the past four years in promotional discounts, distribution expenses and A&P).

Capex plans to keep ROCE subdued until FY19E

Given capex spends on two greenfield plants at Vizag and Mysuru over FY18-19, we expect ROCE to remain subdued at 25% levels till FY19. Expansion should strengthen company’s presence in southern India and can help stabilise freight costs which have been rising.

Valuation/Risks

APNT is trading at 44x FY19E PE and 37x FY20 PE based on our estimates. While valuations limit potential for re-rating, we believe EPS trajectory pick-up to high teens should help sustain multiples. Our PT values stock at 45x Dec 19E EPS (10% premium to its five-year average multiple of 42x). Key risks: 1) lower volume growth; 2) sharp rise in key inputs like crude and Tio2.

Executive summary

Asian Paints is the market leader in the decorative paints segment in India and has been consistently gaining market share from its peers. We believe it is best-positioned to gain from the overall recovery in demand, led by its strong penetration, strong brand and complete range of products, from mass to premium. Post two consecutive years of single-digit revenue growth, we expect APNT to clock 14.9% CAGR over FY18-20E, led by 10% volume CAGR over the same period.