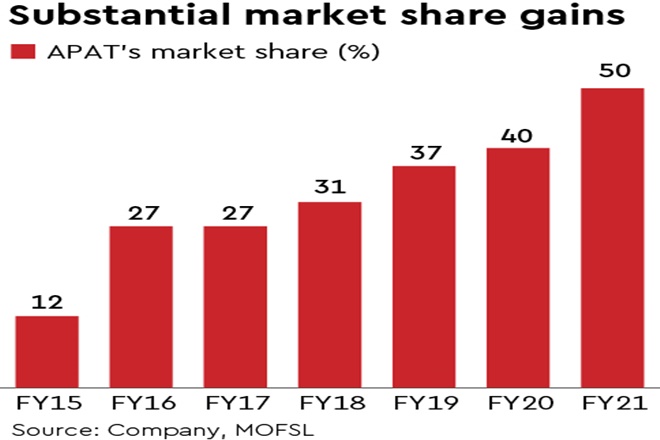

APL Apollo Tubes (APAT) is the largest manufacturer of Structural Steel Tubes in India. APAT’s diversified product portfolio and pan-India presence helps in mitigating concentration risk. Higher sweating of assets (capacity utilisation at 63%) will lead to kicking-in of operating leverage and better profitability. Robust distribution network, along with warehouses, higher retail network, and SKUs are expected to improve last-mile connectivity. Steady capacity addition, increase in penetration, and gains from unorganised players are expected to improve market share from current levels (~50%).

The merger with Apollo Tricoat Tubes’ (Tricoat) is margin and RoE accretive and is expected to create value for shareholders. Common ad spends and distribution network, along with other synergy benefits, is expected to benefit APAT in the medium-to-long term. Tricoat’s Ebitda/MT is 1.7-1.9x higher than blended Ebitda/MT, and is expected to further increase revenue share of VAP, improve overall margin, and further de-commoditise the business.

Marginal increase in domestic steel consumption is expected to have a profound impact on domestic volumes of Structural Steel Tubes, thereby benefitting APAT significantly. Warehousing, modular housing, modernisation of rural, semi-urban as well as urban houses, urban infrastructure, and urban real estate are some of the major growth drivers for the Structural Steel Tubes industry.

We estimate 20%/35% revenue/PAT CAGR over FY21-24E, led by increasing Ebitda/MT and higher sweating of assets. We value the stock at 35x Sep’23E EPS to arrive at our TP of Rs 2,065. We initiate coverage with a Buy rating.