Did you know that Nvidia’s two secret customers accounted for nearly 40 per cent of the company’s revenue? The company recently revealed its quarterly earnings report, where $46.7 billion in income was mainly made up of two clients, thus highlighting how the chipmaker relies on powerful clients to keep its shop running.

Nvidia hasn’t revealed the names of these customers yet but the industry believes that they must be one of the world’s few big tech firms that rely solely on Nvidia’s specialised chipsets. Analysts and experts have suggested that these confidential customers could be ‘hyperscalers’, i.e., the world’s largest cloud computing and technology companies.

Based on the filings in the report, ‘customer A’ contributed 23 per cent of revenue, which was roughly $10.7 billion in revenue alone. ‘Customer B’ made up 16 per cent of revenue, which was about $7.5 billion in revenue. These are substantial figures as far as revenue figures are concerned.

Nvidia’s secret customers give them 40 per cent revenue

The top candidates widely speculated to be these mystery clients are Microsoft, Amazon Web Services (AWS), and Google Cloud. Meta is also considered a strong possibility, given its huge investments in AI infrastructure. These technology giants are currently engaged in a high-stakes AI race to dominate the segment.

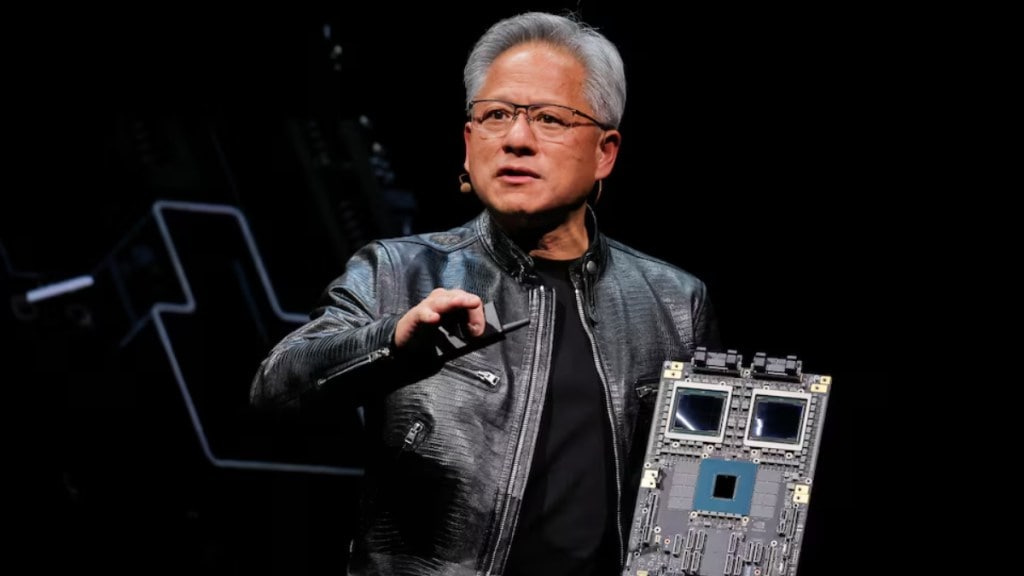

To ensure their victory, these brands to build out the necessary infrastructure to dominate the ever-expanding AI services market. Nvidia’s high-performance GPUs play a critical role here as their chips form the backbone of these large supercomputers running advanced generative AI models and training data. It is said that the AI business has generated such a substantial amount of wealth for the chipmaker that its original gaming division’s income feels like a side business in comparison.

Will Nvidia gain more secret customers in the future?

Nvidia’s presence in the AI business is of paramount importance to cloud-based businesses and generative AI companies. As the world edges towards superior automation in the days to come, more tech firms are going to need these advanced AI chips in their data centers to run generative AI-based services. Nvidia’s advantage in hardware design should lend it an advantage, supplying the most advanced chips to these companies.

As far as the secrecy surrounding the names is concerned, they could be attributed to the competitive nature of the cloud and AI sectors. These major players prefer to keep their infrastructure scaling and strategic investments private to prevent competitors from gaining insights into their future plans.

On the other hand, this over-reliance on two big clients exposes a major risk factor: an over-reliance on a very small customer base. As the AI arms race continues, the financial health of Nvidia may be linked to the investment decisions of a handful of tech titans, thus putting the firm at risk for the future.