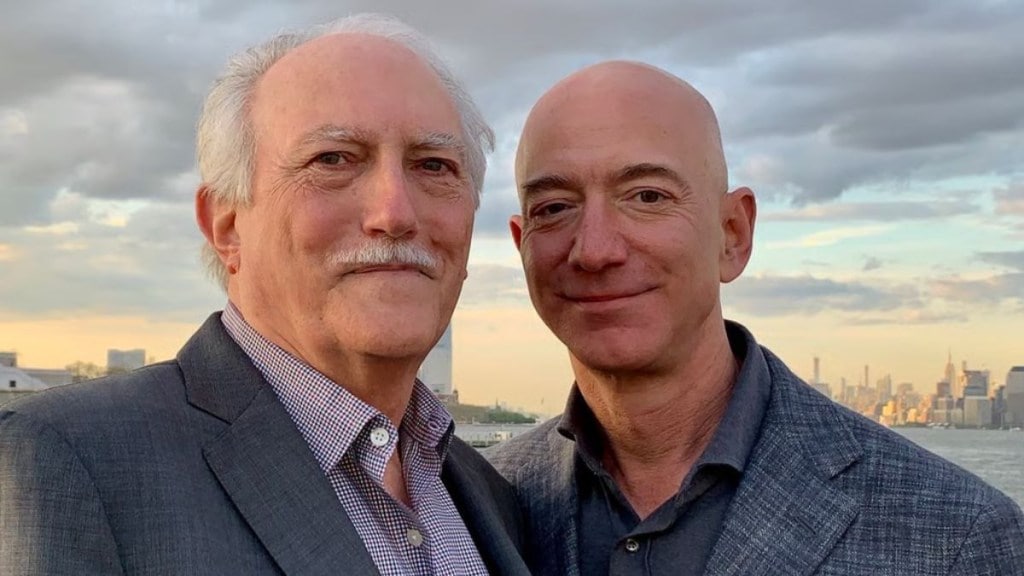

Mike Bezos, the 79-year-old father of Amazon founder Jeff Bezos, is reportedly planning a “massive expansion” of his family office, which manages a fortune worth more than $40 billion and supports family members. According to a report by The Wall Street Journal, he was on the lookout for a CEO to oversee this capital.

Chief executive Valeria Alberola, who previously worked for Walmart heir Ben Walton and his wife Lucy Ana Walton as CEO of ZOMALAB — their private family office — has been hired by Mike Bezos’ team. Several people briefed on the matter said she will be managing the Bezos family office from Miami. Alberola oversaw investments and philanthropic activities for the Waltons and has built an impressive portfolio. According to her LinkedIn profile, she graduated from Pontificia Universidad Católica de Chile and earned her M.B.A. from Northwestern University’s Kellogg School of Management.

What is a family office?

For those unfamiliar, family offices are private firms established by wealthy families to manage their wealth. They also provide a wide range of services such as tax and estate planning, concierge management, philanthropic coordination, and support with family governance and education. Their ultimate purpose is to deliver comprehensive, holistic, and personalized management of a family’s assets and needs. A family office can serve one or multiple families.

The Bezos family office, named Aurora Borealis, was established in 2020 to manage the assets of Mike and Jacklyn Bezos, Jeff Bezos’ parents, according to the WSJ report. Jacklyn Bezos, who sadly passed away in August 2025 due to Lewy body dementia, was a driving force behind the Bezos Family Foundation, serving as its president for more than 20 years. Together, the couple actively participated in philanthropy, donating $710.5 million to the Fred Hutchinson Cancer Center through the foundation.

The plan for Aurora Borealis’ extensive expansion was already in the making before Jacklyn Bezos’s death WSJ reported. The family office was considering employing an investment team to diversify Mike Bezos’ investment portfolio beyond Amazon.com according to sources. They are also currently seeking a chief investment officer. The plan is to rapidly grow Aurora Borealis “to support the second (G2) and third (G3) generations,” according to a document by search firm Russell Reynolds.

What the rapid increase in number of family offices in recent times might indicate

In recent years, the number of family offices has surged rapidly. Deloitte estimates that 8,030 single-family offices existed worldwide as of 2024 — a 31% increase since 2019. The firm predicts this number will grow to 10,720 by 2030. The great wealth transfer from baby boomers — expected to pass trillions of dollars in assets to the next generation in the coming years — along with entrepreneurial activity, is fuelling this growth.

By some measures, this is the most rapid accumulation of wealth by the ultra rich in the U.S. since the Gilded Age. For context, the Gilded age saw the astronomical rise of industrialists such as John D. Rockefeller, Andrew Carnegie, J.P. Morgan, Cornelius Vanderbilt and Leland Stanford.

These financiers were key figures during this era and were infamously known as “robber barons” due to their ruthless and unethical business tactics which included: severe exploitation of workers, forming trusts to monopolize markets and eliminating competition. Intimidation, fraud, violence and political corruption featured frequently in business dealings.

So, with the increasing wealth disparity not only in the U.S. but also the world, the increasing number of family offices raises serious concerns for the average person.

Family offices have become an increasingly attractive option for capital sources in Wall Street and Silicon Valley. Wealthy families are now seen as a stable and quick growing source of money for investment firms, versus the traditional public pension and other institutions.

The Bezos’ are one of the many wealthy families in the world, perhaps even the creme de la creme amongst the wealthiest. Mike Bezos’ plans for his family office indicates a growing trend in how the ultra wealthy are now choosing to manage their money: they are not only consolidating their assets but also seeking to massively expand their fortunes through sophisticated, institutional-style management.