In a market where Netflix, Amazon Prime Video, and JioHotstar loom large, a quieter revolution is reshaping how India watches its stories. Regional over-the-top (OTT) platforms, once considered niche players, are gaining serious ground. Not only in content volume but also in loyalty, cultural resonance and, increasingly, reach. Platforms like Hoichoi and manoramaMax have doubled down on language-specific storytelling, and the results are compelling. The higher viewer engagement, sharper output, and audience trust that the national players are now trying to catch up to.

India has more than 15 million paying OTT households, with an average of 2.5 subscriptions per household. But what’s striking isn’t just the volume, it’s what they’re watching. According to EY-FICCI’s 2024 report, 48% of OTT content last year was in regional languages, and 25-50% of total consumption was in dubbed or subtitled formats. The idea that regional content is “limited” to its state or diaspora is now dated. “Language is no longer a barrier,” says an OTT analyst, adding: “People are watching Malayalam thrillers in north India, Bengali social dramas in Karnataka, and Tamil shows in Gujarat. Local production houses are seeing India as a market, not just the audience from the state.”

This cross-pollination is aided by smart bundling, AI-led recommendations, and a cultural moment where authenticity trumps gloss. Add rising broadband penetration and smart TV adoption in tier-2 and tier-3 cities, and the stage is set for regional platforms to claim more.

The strategy: Hyperlocal focus, pan-India vision

When Hoichoi launched in 2017, streaming in India was still dominated by big-budget Hindi and English content. “We took a risk by making Hoichoi subscription-first, and doing 100% Bengali,” says its COO Soumya Mukherjee. “But we knew there was a huge untapped library and audience.” Today, Hoichoi has over 15 million users, with 30% of its subscribers based abroad in countries like the US, UK, Australia and Malaysia. It releases 25 originals a year and has built a catalogue of over 600 Bengali films.

Contrast this with national platforms that often manage just 6-8 pieces per language per year. “The ones winning are those releasing 30-35 pieces annually in one language,” says the analyst. That intensity, coupled with insight into local sentiment and cultural cues, creates an unbeatable edge.

Another standout, ManoramaMax, echoes a similar approach. “Unlike platforms chasing pan-India reach with a broad content slate, we follow a region-first, audience-intimate model. ManoramaMax is agile, locally rooted, and more focused on community engagement,” says its COO Satheesh PR. Based in Kerala, ManoramaMax blends subscription video on demand (SVOD), advertising-based video on demand (AVOD) and B2B revenues, curates a catalogue of gritty thrillers and satirical comedies, and actively works with local talent. “Loyalty comes from community resonance, not from just being visible,” he adds.

“Our viewership is from across the state of Kerala. This trend reflects the growing internet penetration and mobile usage in smaller towns, which has been a key focus of our expansion efforts. We’ve been seeing an uptick in international audiences, particularly from countries with large Indian diaspora communities, like the GCC (Gulf Cooperation Council) countries, the US and the UK,” says Satheesh.

This view is echoed by national streamers expanding their regional footprint. “Great stories are emerging from every corner of the country, and we’re listening closely,” says Krishnan Kutty, head of cluster-entertainment (south), JioStar. “Whether it’s a creator from Visakhapatnam crafting a youth drama or a gripping cop story rooted in Kochi, we’re seeing incredible authenticity. What we’re backing are stories that speak to universal values, stories about identity, aspiration, family, and justice. These are the kind of narratives that connect deeply and scale widely.”

A small state like Kerala, he says, creates stories that travel nationwide. “Up to 80% of the consumption on our platform for Malayalam content is outside the state. By adapting successful shows across our 10-language network, we see firsthand that great stories truly transcend borders,” he adds.

The economics: Cost-efficient, impact-heavy

One reason regional OTTs are doing better than expected? They’re not burning cash. In 2024, high-cost OTT content fell by 12% as platforms shifted focus to profitability. Regional players, with leaner production budgets and stronger instincts, were better suited to thrive in this new reality.

Hoichoi, for instance, works closely with both new and established directors, mentoring fresh voices while investing in content quality. “We no longer try to mimic cinema. OTT storytelling is its own beast, intimate, mobile-first, personal,” the COO explains.

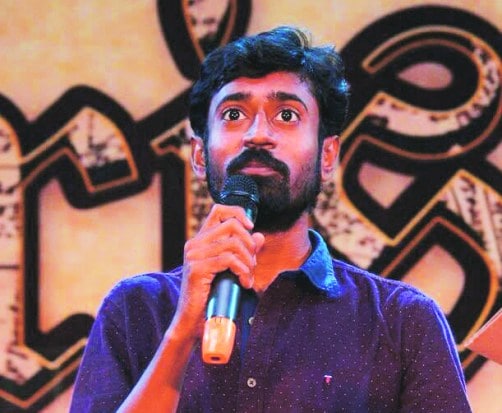

OTT also offers more shelf life. “You don’t have to chase trends or worry about box office. The story finds its moment even months later,” says Geevee Vignesh, a casting director-writer from Tamil Nadu. “In theatres, we need the ticket-selling aspect, it’s heavily star-driven. Even with OTTs, we do that, but there’s some sort of scientific breakdown of the casting, from paper to budget,” he adds.

The creators: Format drives form

This shift in medium has given writers a different kind of playground. “I personally refrain from pop culture references or quotes, as they expire soon. Television can play around with current affairs and be volatile, but we may want to check how the writing ages with time. While writing, you also know that whoever is directing, whether it’s you or any other director, shots and sound design are approached for OTTs and not a huge theatre,” says Geevee, adding: “You don’t do wide shots. You don’t rely on crowd appeal. The storytelling is more psychological, sociological, even literary.”

This shift has also democratised casting. “We’re not bound to stars. In OTT, the story decides the actor, not the other way around,” he says. In one of his recent shows, 160 people were cast from local communities, balancing reach with authenticity.

The demands of OTT, particularly in regional formats, are also shaping creative structure. “We’re looking at character-driven stories over plot-driven spectacles,” says Aritra Sengupta, screenwriter and producer. “In web shows, the goal is to create memorable characters who can carry multiple seasons, like Panchayat. In the regional space, what works is authentic local representation. If I’m watching a Bengali show, I want to see a side of North Calcutta or a remote Bengal village I’d never see on a national platform,” he adds.

For Sengupta, the point of regional content is not just language, it’s texture. “It’s not just one ‘Bengali’ voice. There are dialects, subcultures, and geographies that make it layered. Regional storytelling offers something no pan-India show can,” he says.

Yet authenticity doesn’t mean isolation. “A Gujarati show done well can appeal to a Bengali viewer,” he says. “The problem is not with the audience, it’s with how we label, market, and distribute. We assume people only want to watch shows in their own language. But we’re watching Korean, Spanish, Turkish, why wouldn’t we watch each other?”

The writing process is also shaped by budget. “We work with tight timelines and smaller crews. That means fewer characters, limited locations, and tighter scripts. So writing has to be smart, it must absorb constraints and still deliver a quality experience. That’s the hardest and most interesting part,” he adds.

The platforms: Data, instinct, and involvement

Almost all platforms now operate on a studio model, deeply involved in development. “They bring international benchmarks, cultural nuance, and structured feedback,” says Sengupta, adding: “It’s not a constraint, it’s a challenge. Often, limitations push better storytelling.”

Amazon Prime Video, meanwhile, is responding by expanding its local slate. “We’ve developed over 105 Indian Originals in Hindi, Tamil, and Telugu,” says Nikhil Madhok, director & head of Originals, Prime Video India. “In 2023 alone, we announced nearly 70 new shows and movies across ten languages,” he adds.

Beyond Originals, Prime Video’s aggregation model allows it to host platforms like Hoichoi, ManoramaMax, and Chaupal as add-on subscriptions. This boosts their reach while strengthening Prime’s library. “We want to be a one-stop entertainment destination,” Madhok says.

Their rental model is growing too. 5,000 of their 8,500 titles are rented every month, many in regional languages. “We often get compared to other SVOD streamers, but we believe we are playing a different game. We want to be our customers’ first-stop entertainment destination, where they can discover and watch the world’s largest selection of series, movies, and documentaries in one app,” adds Madhok.

Kutty agrees. “The Indian diaspora doesn’t just consume content, they validate its cultural truth,” he says. “For them, anything rooted in authenticity becomes a bridge back home. They’re seeking stories that reflect the values, nuances, and evolving identity of India, not just nostalgia, but also relevance.”

The future: Consolidation, innovation, expansion

OTT consumption is expanding, both in depth and geography. Viewership from tier-2 and tier-3 towns is now mainstream. Platforms like Chaupal (Punjabi, Haryanvi, Bhojpuri), Aha (Telugu, Tamil), SunNXT (multi-language South), and Planet Marathi are scaling fast. Meanwhile, state governments are getting involved: Kerala’s CSpace is live; Karnataka is building a Kannada platform.

With AI-driven localisation and script generation, regional OTTs can now scale faster, cut costs by up to 30%, and serve new micro-markets. “Even Instagram reels are evolving into multi-episode micro-dramas,” says Aritra. “YouTube’s not dead either. The platforms may shift, but the hunger for stories is growing.”

“India’s digital video scale is massive, with 500-600 million users consuming 4-5 hours of content daily across all formats,” says Kutty. “The real challenge isn’t what to do, but what not to do. We see untapped opportunity in the space between premium long-form dramas and social storytelling, and want to keep innovating here until we find formats that do two things, build greater consumer connection and strengthen the economics of the streaming business.”

“With AI-enabled OTT experiences, users could be given entire worlds where they create their own heroes, their own plotlines, and watch films that are entirely their own. Imagine you decide, in your version of Game of Thrones, whether Ned Stark dies or not… and watch it. Your neighbour may be watching a different one, based on how they choose,” adds Geevee.

Still, not all will survive. Many smaller platforms have shut shop due to poor monetisation or limited bandwidth. Consolidation is inevitable, via mergers, syndication, or strategic acquisition. Those without a sustainable content pipeline or loyal user base may end up licensing their libraries to larger players.

The verdict: A new centre of gravity

The Indian streaming wars aren’t about who’s shouting loudest anymore. They’re about who listens best, who understands regional nuance, captures local stories, and builds a narrative ecosystem around identity. Regional OTTs are doing just that. They’re rewriting the rules, not by mimicking the giants but by doubling down on what makes them different, intimacy, language, character, and place. Their storytelling doesn’t just entertain, it resonates.

As India’s 1.4 billion citizens stream across 22 official languages, the next phase of OTT growth will be hyper-personal, hyper-local, and surprisingly universal.

As Geevee explained, borrowing from ace Indian director Vasanth’s words: “A work of art that’s local in theme and international in appeal makes further sense in time and demography.”

The giants are adapting. But the quiet winners? They’ve already found their voice. And their audience is listening.