In line with a weak global smartphone market growth, India’s shipments fell 6% year-on-year to 44.6 million units in the September quarter largely due to a weak demand in the low-end mobile phone segment, according to a report by market analyst firm Canalys.

“Hit by inflation, entry-level device contribution declined this year, while the mid-to-high segment performed relatively well thanks to aggressive promotions,” said Sanyam Chaurasia, an analyst at Canalys. The market analyst firm expects an improvement in the consumer confidence with slowly easing inflationary environment.

Also read: Take note: Someone at Google trolled Apple on Twitter, using an iPhone

Sequentially, India’s smartphone shipments grew 23% in September quarter from 36.4 million units, which can be attributed to an improved demand owing to the festive season.

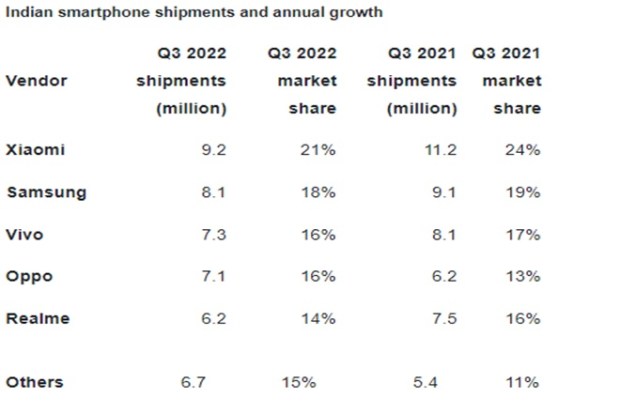

Among the smartphone makers, Xiaomi topped the list of shipments with 9.2 million units as the brand gained traction from July’s online sales ahead of the festival season. Samsung shipped 8.1 million mobile units and saw strong momentum in the mid-high-end category owing to aggressive offers and promotions, according to Canalys. Other chinese brands such as Vivo and Oppo shipped 7.3 million and 7.1 million mobile units, respectively, whereas Realme came fifth with 6.2 million shipments.

“Oppo’s OnePlus and vivo’s iQOO were the two brands driving mid-range growth in the e-commerce channel during this period. Ultra-premium category smartphones, especially older generation flagships, also experienced strong demand momentum amid price cuts. Samsung offered deep discounts on its older generation Galaxy Z Fold3 and latest Galaxy S22 series in online and offline channels,” Chaurasia said.

Barring Oppo, all the top smarphone makers witnessed a dip in the shipments on an year-on-year basis in the range of 9-18%. For Oppo, the shipments grew 14% YoY, according to the report.

While Xiaomi topped the list of shipments, its market share in India fell to 21% in the September quarter from 24% in the year ago period. Players such as Samsung, Vivo, Realme too saw a dip in their marker shares. As per the report, the market share of Samsung in the quarter was 18%, followed by Vivo and Oppo at 16% each, and Realme at 15%.

With the rollout of 5G services by telecom operators, analysts see this as a perfect timing for smartphone makers to push their 5G portfolios. On affordability of 5G devices, while Canalys notes that Jio and Google are working on developing a low cost smartphone, but they do not see coming of an ultra-affordable category of smartphones in the near term owing to higher prices of 5G chipsets.

Also read: Nothing Phone 1 now ‘truly’ 5G-ready as Nothing adds support for Jio 5G with new update

The challenges of higher raw material will continue in the December quarter, which would put pressure on the operational performance of the vendors, the analyst firm noted.

In the September quarter, the growth of global smartphone shipments too fell 9% year-on-year to about 100 million units, which was the worst performance since 2014.