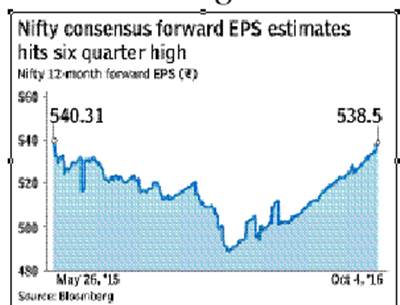

Consensus analyst estimate for Nifty 50’s 12-month forward earnings per share (EPS) has hit a 16-month high of R538.5, data sourced from Bloomberg shows. This means that at Wednesday’s closing of 8,743.95, the Nifty is trading at 16.2x forward P/E. According to the estimates, Nifty50’s EPS is expected to grow by 2.5% (y-o-y) compared to three successive quarters of negative growth and a very low growth of just 0.8% (y-o-y) in the quarter ended September 2015.

The highest-ever forward EPS estimate for the Nifty was for the quarter ended December 2014, when post the Modi government taking over, analysts had expected Nifty’s EPS to grow by 18.9% (y-o-y) to R546.7.However, with the Nifty correcting over 25% between March 2015 and February 2016, there were a plethora of downgrades, resulting in the consensus EPS estimate dropping to a low of R505.2 for the quarter ended March, 2016.

But with an over 30% rally in the Nifty from the lows made in February, analysts have again started upgrading EPS estimates resulting in the recent surge.

With public sector banks balance sheet cleanup exercise already over, analysts are now betting on lower interest rates, a good monsoon, benign commodity prices, US Fed in pause mode and seventh pay commission payouts to boost the bottom lines of Nifty constituents.