Reliance’s stock price has surged post its announcement last month to start monetisation of Jio from 1 April. Yet, we do not believe underlying fundamentals have changed materially to justify the move – monetisation has been advanced by 1-2 quarters at best vs previous expectations. Underownership of RIL in FII and DII portfolios is likely a key factor in price movement in our view. Prime enrollment data, expected from end-March, will be key to watch for.

No material change in fundamentals: We do not believe the fundamentals for Reliance have changed significantly based on last month’s announcement. Monetisation of Jio has been advanced by 1-2 quarters at best vs previous expectations; capping of ARPU at R303/month through prime membership is in line with the expectation of discounting even after start of monetisation.

We attribute $18 bn of enterprise value to Jio in our SOTP based on 25% revenue share in steady state (by FY22e), 45% Ebitda margin (by FY24e) and Ebitda break-even in H2FY19. Based on the current price of Reliance, we believe market is implying $23 bn of EV for Jio. This compares with $25-27 bn of EV for Bharti’s India business with revenue market share of 35% and $12 bn for Idea with 20% share. Based on our sensitivity, Reliance’s share price is implying steady state market share of 30-35% or Ebitda margin of 50-55% or a much faster path to profitability.

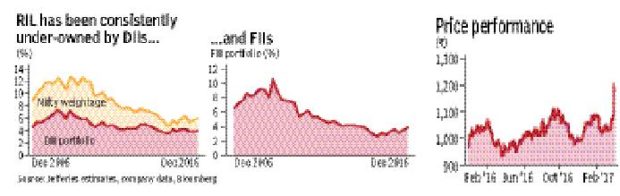

Under-ownership a key technical factor: More than the fundamentals, Reliance’s underownership in both FII and DII portfolios vs benchmark is likely a key factor in its recent price movement, in our view.

Prime enrollment data key in near-term: Given the structure of Jio’s prime membership plan, enrollment data should be available at the end of March and get reinforced in Q1FY18 as monthly payments start. We believe the market is expecting 50% of the 100 million subscribers to be retained. Response of other telcos over the next few weeks to protect market-share amongst higher ARPU customers would also be key.

Maintain Hold: We remain cautious on Reliance, as we believe high underlying liability on balance sheet leaves little room for equity upside even assuming full upside from downstream projects and reasonable value for Jio.

Valuation/Risks: Our price target of R1,060 for Reliance is based on a SOTP of the different businesses and implies 12x FY19e P/E.

Key risks: (i) higher/lower downstream profits, (ii) positive/negative surprise on Jio performance post launch, (iii) corporate action.

You may also like to watch this video

Company description: Reliance Industries is one of the largest private sector companies in India. It is vertically integrated across the oil & gas supply chain with activities spanning exploration & production, refining and marketing of petroleum products and manufacture of petrochemicals and textiles. Its Jamnagar refining complex with capacity of 1.24 mbpd is one of the largest and most complex single location refineries in the world. Reliance is the largest polyester yarn and fibre producer in the world and among the top five to ten producers in the world in major petrochemical products. The company also has presence in retail, infotel and special economic zones through its subsidiaries.