India’s crude import bill may decline by a massive $17 billion or 17% year-on-year in FY21 if the Indian basket price remains subdued around the current level of $50/barrel through the next fiscal, in what could give a big relief to the country’s current account.

The price of the Indian crude oil basket, which stood at $64 per barrel in January, dropped to $55 in February. Brent crude oil prices rose on Monday, reversing a drop to multi-year lows last week, as hopes of a deeper cut in output by Opec and central bank stimulus countered worries about damage to demand from the spread of coronavirus.

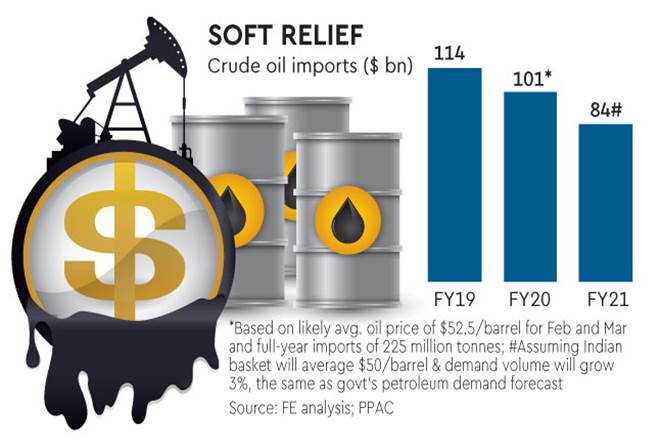

According to an FE analysis, the imports may fall to $84 billion in FY21, against $101 billion this fiscal, if the price of domestic crude basket averages $50 per barrel. Similarly, the fall in imports may be to the tune of $25 billion in FY21 to $76 billion, if the price crashes to $45 per barrel. In case, prices again inch up and touch $55 a barrel, the import bill may drop by just $8 billion next year.

The analysis factors in an expected 3% growth in FY21 crude oil import volumes, in sync with the projection of an advisory body of the petroleum ministry for the country’s overall oil demand. The Petroleum Planning and Analysis Cell has forecast crude oil import of 225 million tonne for FY20. The estimate for the current fiscal is based on the provisional imports up to January and the likely purchases in the remaining two months at an average price of $52.5 per barrel. Of course, there are risks to these projections from any potential cut in output by Opec to bolster prices, or even easing measures by central banks around the world to blunt the impact of the coronavirus outbreak on already-faltering growth. Also, any sharp depreciation of the domestic currency will negate some of these gains for the country. The rupee hit an over one-year low of 72.73 against the dollar on Monday.

India imports close to 85% of its annual crude oil requirements, and its dependence on purchases from overseas has only risen in recent years, as domestic production falters in the absence of adequate incentives. The massive oil bill (it makes up for 21% of the country’s imports) is the biggest driver of the country’s trade deficit, and consequently current account deficit (CAD). The country’s CAD jumped to 2.6% of GDP in the last fiscal, against 1.9% in the previous year, primarily due to a 23% rise in oil price. In the current fiscal, the CAD is expected to ease to 2.4%, according to a Crisil estimate, as oil prices eased again.

Brent crude touched $50.40 a barrel, up 73 cents in intraday trade, having hit its lowest since July 2017 at $48.40 on February 28. Monday’s was the first gain for brent crude oil after six sessions of losses triggered by coronavirus scare.

The virus, which originated in China, has already killed about 3,000 people and spooked global markets. Equity markets globally witnessed their biggest rout since the 2008 financial crisis last week, even though European and Asian shares saw relative stability on Monday. The extent of last week’s losses led analysts to expect policy responses from the US Federal Reserve to the Bank of Japan, which hinted on Monday that it would take required steps to soothe frayed nerves.