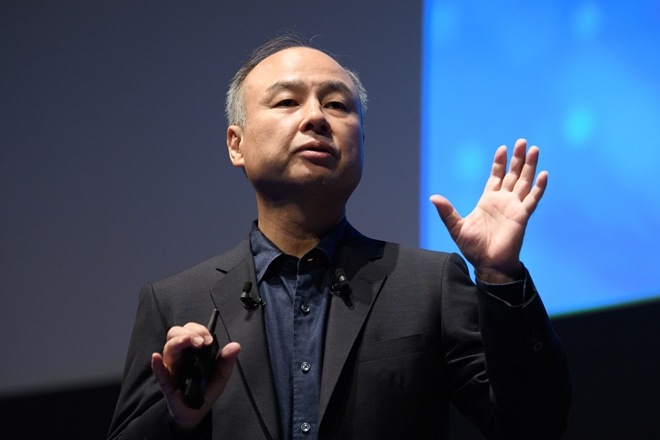

A week after SoftBank unveiled $9.5 billion rescue package for co-working company WeWork witnessing among the most dramatic business events in recent history, the global startup fund is perhaps sticking to its formula of investing tonnes of capital in startups to acquire biggest market share and turning them into large technology businesses without much stress on profitability. “Of course we provide the growth capital but that money is available from many other sources. So we are providing the total stimulus for them (entrepreneurs) to grow much bigger (and) quicker,” SoftBank Chairman and CEO Masayoshi Son said at the Future Investment Initiative forum in Riyadh on Wednesday.

Defending his strategy of identifying “entrepreneurs who have the greatest vision to solve the unsolvable,” Son said that the fund backs such entrepreneurs with the “cash to fight.” Son’s comments come days after he told Nikkei Business magazine that he felt “embarrassed and flustered” by his track record given the string of bets by SoftBank Vision Fund (SVF) 1 that came into the firing line because of poor IPO performances.

“VCs made money in a way where one investor made money at the expense of the next one who is buying into the company. This had to stop at some point and IPO is that point,” Ashutosh Sharma, Vice President and Research Director, Forrester recently told Financial Express Online.

Also read: Tech IPOs debacle spooks investors; ditch growth for profitability as new mantra to create unicorns

“It is not unusual for the world’s leading technology disruptors to experience growth challenges as the one WeWork just faced,” Son said in a statement while announcing the bailout package for WeWork.

SoftBank has already deployed reportedly around 80 per cent of the $100 billion from SVF 1 and henceforth Son would be focusing more companies showcasing clear profitability path and IPO, CNBC reported. Nonetheless, it would be interesting to understand how Son marries his focus on profits with hyper-growth.

“What I do is stimulate entrepreneurs. I am also an entrepreneur. So if I were them, how do I accelerate the growth and get a much bigger market share,” Son said at the event without talking about the profitability aspect even as he remained committed to investing in “unicorns that are number one in each of the categories.”