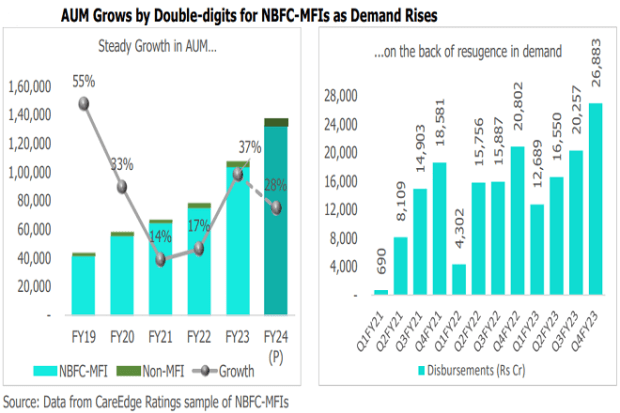

Microfinance sector: The favourable macroeconomic climate and renewed demand, which has led to a surge in disbursements over the past few quarters is expected to continue with the portfolio of NBFC-MFIs (non-banking financial company-microfinance institutions) likely to grow at 28 per cent year-on-year in the current financial year, said credit rating company CareEdge. NBFC-MFIs had surpassed banks in the overall microfinancing landscape, constituting approximately 40 per cent of the total outstanding microfinance loans as of March 31, 2023, compared to 34 per cent for banks.

In terms of asset quality, although on an improving trend, it still remains moderate as compared to the pre-Covid level owing to additional slippages arising from the restructured portfolio, according to a CareEdge report.

Also read: ‘Why microfinance institutions might not be working in favour of women empowerment’

The MFI sector had taken the cumulative impact on the credit cost of around 19 per cent of the portfolio, as on March 31, 2020, from FY21 to FY23 due to Covid-19. However, with an improving collection efficiency trend, gross NPA is expected to improve to 2 per cent in FY24 from a peak of 6.26 per cent in FY22.

The profitability indicators also improved with the expansion of net interest margins, registering approximately 10.1 per cent during FY23, as opposed to the 9 per cent in both FY21 and FY22. This upswing can be attributed to the abolition of the lending rate cap regime in the revised RBI regulations and reduced interest income reversals due to the improved asset quality.

According to CareEdge, while the comprehensive influence of the revised regulations is yet to fully materialize, it foresees a further escalation of NIMs in the forthcoming FY24.

Also read: Microfinance gross loan portfolio jumps 18% in FY23; write-offs up by 7.7%: Report

Meanwhile, according to the report by credit bureau Crif High Mark, the gross loan portfolio (GLP) or portfolio outstanding of the microfinance sector grew 17.9 per cent YoY as of March 2023 to Rs 3.37 lakh crore from Rs 2.86 lakh crore as of March 20222.

NBFC-MFIs continued to dominate the market with a portfolio share of 37.3 per cent amounting to Rs 1.26 lakh crore followed by banks with 33.1 per cent share worth Rs 1.11 lakh crore and small finance banks with 16.6 per cent share worth Rs 56,075 crore during March quarter.