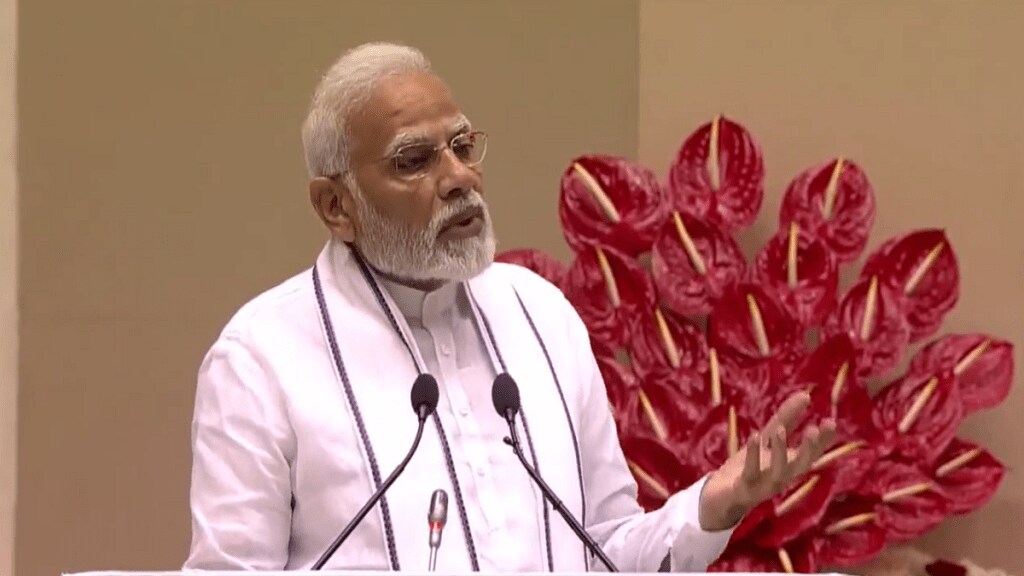

Credit and finance for MSMEs: Prime Minister Narendra Modi on Wednesday hailed the government’s Stand-Up India scheme, which enables credit for women and SC-ST entrepreneurs, for sanctioning over Rs 40,700 crore loans since its launch in April 2016. “Today we mark #7YearsofStandUpIndia and acknowledge the role this initiative has played in empowering the SC/ ST communities and ensuring women empowerment,” PM Modi said in a tweet as the scheme completed its seven years of operation.

“It has also boosted the spirit of enterprise our people are blessed with,” he added in response to an update by the finance ministry on the scheme’s performance.

According to the latest data available on the scheme’s portal, 90 per cent of the loan applications and 86.3 per cent of the loan amount have been sanctioned so far. The scheme had received 2.04 lakh applications involving Rs 48,046 crore, of which 1.84 lakh applications involving Rs 41,468 crore were sanctioned as of April 6.

The share of women beneficiaries under the scheme was 80 per cent with 1.44 lakh loans amounting to Rs 33,152 crore sanctioned out of 1.80 lakh loans amounting to Rs 40,710 crore sanctioned till March 21, 2023, as per the data shared by the finance ministry on Wednesday. On the other hand, 26,889 loans involving Rs 5,625 crore were sanctioned to SC entrepreneurs and 8,960 loans involving Rs 1,932 crore were sanctioned to ST entrepreneurs.

“The scheme has created an eco-system which facilitates and continues to provide a supportive environment for setting up green field enterprises through access to loans from bank branches of all scheduled commercial banks. Stand-Up India Scheme has proved to be an important milestone in promoting entrepreneurship among SC, ST and women,” finance minister Nirmala Sitharaman said on the occasion.

The scheme facilitates loans from scheduled commercial banks (SCBs) between Rs 10 lakh and Rs 1 crore to at least one SC or ST borrower and one woman borrower per bank branch for setting up greenfield enterprise in manufacturing, services or trading sector and also for the activities allied to agriculture.