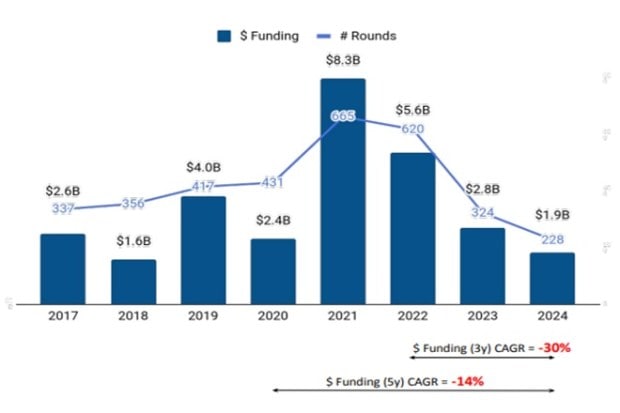

The Indian fintech ecosystem was ranked third globally in funding received in 2024, trailing only the US and the UK despite a 33 per cent decline in the amount invested or deal value and a 29 per cent fall in total funding rounds or deal volume compared to 2023. According to the data shared by market intelligence firm Tracxn, fintech investments dropped to $1.9 billion in 2024 from $2.8 billion in 2023 and $5.6 billion in 2022, largely owing to a broader switch in investors’ sentiment towards a healthy bottomline in emerging technology businesses, the overall slowdown in demand globally, and other geopolitical headwinds.

Fintech investment in India has waned since the peak of 2021 when fintech startups raised $8.3 billion across 665 rounds. In 2024, the funding rounds narrowed to 228 from 324 in 2023 while the count of first-time funded companies also dropped by 24 per cent to 66 from 87 in the preceding year.

Moreover, the year also recorded a lower count of new additions to the soonicorn (soon-to-be unicorn) club from 16 in 2023 to 13 in 2024. Further, funding rounds beyond the Series A were also muted from 100 in 2023 to 97 in 2024.

The funding in late-stage rounds stood at $1.1 billion, with a 42 per cent decrease from $1.9 billion raised in 2023 and a 65 per cent decrease from $3.1 billion raised in 2022.

Early-stage deal value also dropped by 16 per cent to $562 million in 2024 from $667 million recorded in 2023 and a 70 per cent decrease from the $1.9 billion raised in 2022.

However, Q3 2024 emerged as the highest-funded quarter of the year, with $805 million raised—a 61 per cent jump compared to Q3 2023. Moreover, 59 per cent of the total funding in 2024 was secured during the second half of the year, indicating a late-year recovery.

Speaking on the 2024 performance, Neha Singh, Co-Founder at Tracxn, said that despite the global funding slowdown, India’s fintech ecosystem continues to demonstrate remarkable resilience and adaptability. The emergence of two new unicorns and a record eight IPOs in 2024 underscore the sector’s ability to thrive amidst challenges.”

Loan, investment and insurance platform Money View and digital payments company Perfios were the two unicorns in 2024 in comparison to only one unicorn that emerged in 2023.

In terms of IPOs, MobiKwik, Usha Financial, RNFI Services, The Money Fair, Aasaan Loans, Digit Insurance, Trust Systems & Software and IBL Finance were the eight companies going public in 2024.