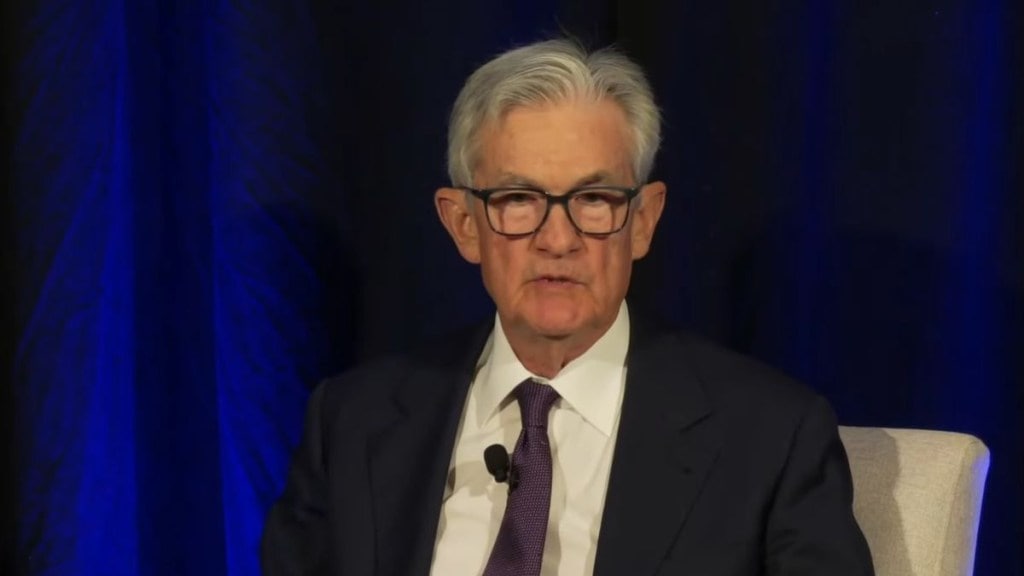

Speaking at the Greater Providence Chamber of Commerce on Tuesday (US time), Jerome Powell hinted at the Federal Reserve slowing down on further interest rate cuts after last week’s significant development in the arena.

Echoing his previous message on challenges in their path, he reiterated in Rhode Island that if the Fed cut rates “too aggressively,” the inflation job would be left “unfinished,” leaving them with no choice but to “reverse course later” and raise rates. On the contrary, if the rate is left too high for a longer period, “the labour market could soften unnecessarily.”

Jerome Powell shares economic outlook in new statement

Addressing business leader in Providence, the Fed chair emphasised their job was to “balance both sides of our dual mandate,” with stable prices and low unemployment as their end-goals.

“Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation,” he said. “Two-sided risks mean that there is no risk-free path.”

Jerome Powell also asserted, “The increased downside risks to employment have shifted the balance of risks to achieving our goals. This policy stance, which I see as still modestly restrictive, leaves us well positioned to respond to potential economic developments.”

Key highlights from Fed’s statement

With US President Donald Trump’s tariffs amplifying uncertainty around inflation, Powell affirmed that the Federal Reserve would be carefully assessing and managing the “risk of higher and more persistent inflation” so that the one-time price hike doesn’t translate into an “ongoing” inflation crisis.

Check out his Jerome Powell’s full speech here:

Speech by Chair Powell on the economic outlook @Provchamber: https://t.co/yvKjS6frQH

— Federal Reserve (@federalreserve) September 23, 2025

Watch live: https://t.co/z7JxK6cDst

Learn more about Chair Powell: https://t.co/3kYVCuuLhW

The Fed chair has long faced Trump’s ire for being “too slow” as the American commander-in-chief continues his attempts to exert influence on the leading bank’s decisions. Powell’s outlook starkly contrasts from that of Trump appointee Stephen Miran, who said on Monday that the Fed show lower its rate to as low as 2% to 2.5% from the current 4.1%.

On Tuesday, Powell foregrounded that the US economy was still showing resilience in the face of drastic trade and immigration policy changes. And yet, he didn’t ignore the notable slowing in the supply of and demand for workers, which he called an “unusual and challenging development.”

Powell on unemployment rate

The Federal Reserve chair further highlighted that the “softer labour market” had resulted in the unemployment rate reaching up to 4.3% in August, with even payroll job gains slowing down over the summer.

“The recent pace of job creation appears to be running below the “breakeven” rate needed to hold the unemployment rate constant,” he said. “But a number of other labor market indicators remain broadly stable. For example, the ratio of job openings to unemployment remains near 1. And multiple measures of job openings have been moving roughly sideways, as have initial claims for unemployment insurance.”

On the other hand, he also cited recent data revelations, saying that the GDP had increased “at a pace of around one and a half percent in the first half of the year, down from 2.5 percent growth last year.” Although housing sector’s activity looked more grim, business investment in equipment and intangibles had rise from last year.

Inflation, on the flip side, has “eased significantly” from its peaking numbers of 2022, said Powell. He still pointed out that it remained “elevated relative” to the Fed’s 2% “longer-run goal.”

“We remain committed to supporting maximum employment and bringing inflation sustainably to our 2 percent goal,” he added at one point, while emphasising that the Fed was committed to delivering on goals linked to American needs.