The US Visa bulletin for August has a special note for the EB-5 applicants, particularly the Unreserved category.

The August bulletin says that in the April 2025 Visa Bulletin, the EB-5 Unreserved final action date for India was retrogressed due to high demand.

It is expected that India will have unused family-sponsored preference numbers that can fall for use in the employment-based categories, including EB-5 Unreserved.

As a result, in the US Visa bulletin for August, the final action date for EB-5 Unreserved has been advanced to use these available numbers.

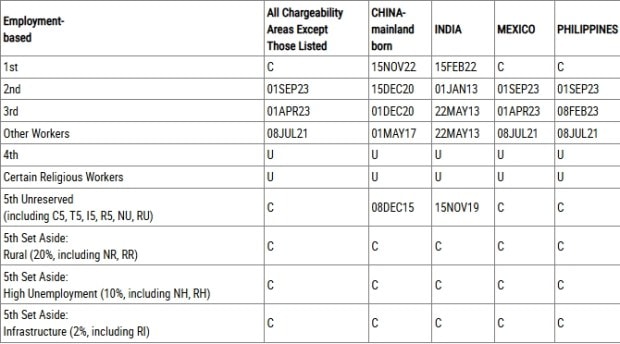

The Final Action Dates For Employment-Based Preference Cases under 5th Unreserved (including C5, T5, I5, R5) category has moved from 01 May 2019 to 15 November 2019.

However, USCIS also cautions that if at any time the EB-5 Unreserved annual limit were reached, it would be necessary to immediately make the preference category “unavailable”, and no further requests for numbers would be honored.

For the Fifth Employment Creation category, 7.1% of the worldwide level, of which 32% are reserved as follows:

20% reserved for qualified immigrants who invest in a rural area; 10% reserved for qualified immigrants who invest in a high unemployment area; and 2% reserved for qualified immigrants who invest in infrastructure projects. The remaining 68% are unreserved and are allotted for all other qualified immigrants.

The EB-5 Immigrant Investor Program provides a reduced minimum investment threshold for foreign investors seeking a U.S. Green Card through Targeted Employment Area investments.

EB-5, an employment-based fifth preference visa, allows investors and their spouses and unmarried children under 21 to apply for lawful permanent residence and become a Green Card holder in the United States.

The minimum investment amount under EB-5 program is $1,050,000 and $800,000 (includes infrastructure projects) for Targeted Employment Area (TEA).

According to a new report from the American Immigrant Investor Alliance (AIIA), demand for EB-5 visas has surged, especially since April 2024.

The report suggested that for an Indian investor considering a TEA investment, should he expect to wait 5 to 10 years or more for a visa, considering the number of rural and high-unemployment investors already queued up?

The answer would be ‘Yes,’ if TEA investors could only get TEA visas. However, a TEA investor may also choose after I-526E approval to be allocated an Unreserved visa.

The Unreserved category also has backlogs, but the Unreserved pre-RIA backlog for India-born petitioners may be cleared within 5 years – making it possibly the soonest-available visa for India-born investors in 2025 regardless of whether they choose to invest in a rural or high-unemployment TEA.

The backlog situation and visa wait times for India TEA investors can also be improved if many Rest of World TEA investors elect to take Unreserved visas following I-526E approval. Otherwise, if TEA investors from India were limited by TEA category and country caps, then wait times would be astronomical, given that pipeline visa demand from China and India far exceeds 7% of rural and high-unemployment visas.