By Sudip Mandal

In the ever-changing world of investments, the concept of diversification has long been hailed as a shield against financial risk. Many investors, however, fall prey to a common misconception – that diversification can be achieved simply by investing in large, mid, and small-cap equity funds. Today, we delve into the depths of this misconception and uncover the profound significance of correlation in the realm of investment.

Understanding Correlation

Correlation, a fundamental concept in finance, is the key to unlocking the true potential of diversification. It measures the relationship between two investment assets or funds, revealing how they move in relation to each other.

The correlation value ranges from -1 to +1, signifying the degree of association between assets. A correlation of +1 indicates identical movement, -1 implies opposite directions, and a value close to 0 suggests a minimal connection, showing relative independence in their price movements.

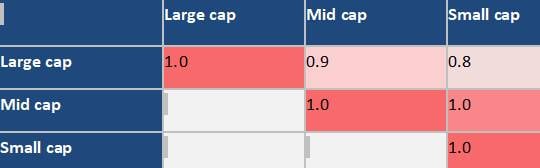

Let’s scrutinize the correlation between large, mid, and small-cap investments:

As evident from the data, the correlation between all three – Large, Mid, and Small Caps – is high, indicating that they tend to move in the same direction.

Why Correlation Matters in Diversification

To achieve true diversification, it is crucial to understand the role of correlation. Diversification aims to spread investments across different assets to reduce risk. When assets with low correlation are incorporated into a portfolio, their price movements are less likely to move in sync. This creates a buffer against market fluctuations, as when one investment faces a downturn, another might perform well, smoothing out the overall returns.

Investors can create a diversified blend by combining asset classes like domestic equities, international equities, gold, and debt. Historical data has repeatedly shown that the best-performing asset class can vary significantly over the years, making it difficult to predict the winning horse, especially for the common investor.

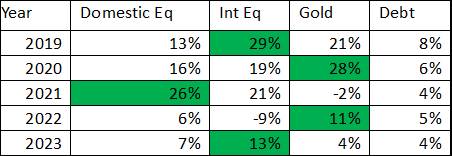

Let’s reflect on the best-performing asset class over the last 5 years

You can see that the best-performing asset class keeps changing, highlighting the unpredictability of the market.

Building a Resilient Portfolio

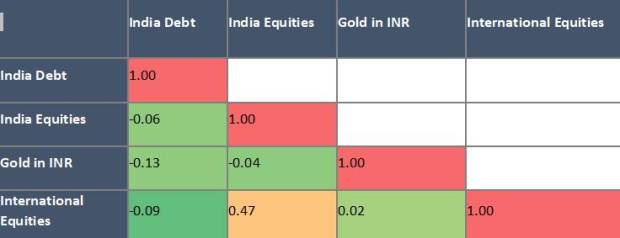

A mix of assets with different correlation levels is the key to capitalizing on the outperformance of one asset class while mitigating the impact of underperformance in another. Let’s look at the correlation between India Debt, India Equities, Gold in INR, and International Equities:

The correlation between these asset classes is low, providing ample diversification opportunities.

To build a resilient portfolio that can withstand economic cycles and deliver consistent performance, investors must delve deeper and analyze the correlation between different assets.

However, for laymen, identifying these correlations might not be straightforward. Thus, a well-considered asset allocation strategy, comprising domestic equities, international equities, gold, and debt, becomes crucial in constructing a successful long-term portfolio.

Fortunately, there are mutual fund schemes specifically designed to handle these complexities and offer a convenient solution for investors.

So, let’s break free from the diversification myth and embrace the power of correlation in constructing a robust investment portfolio. Your journey toward financial success begins with understanding correlation and making informed decisions about your investments. Happy investing!

(Author is VP & Head – B2B Marketing, DSP Mutual Fund (X id: @sudip2185)

Disclaimer: The views expressed above are personal opinions. The information provided in this article is for informational purposes only and should not be considered as financial advice. It is recommended to consult with a qualified financial professional and tax consultant before making any investment or financial decisions. Mutual Fund investments are subject to market risks, and it is important to read all scheme-related documents carefully.