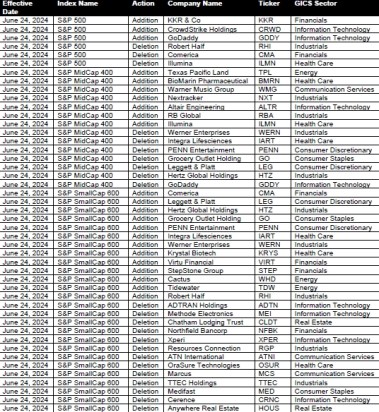

S&P Dow Jones Indices will witness many companies making their trading debuts today. Effective Monday, June 24, 2024, several firms are being added to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices, while others are being withdrawn in a quarterly balance activity.

Altair (Nasdaq: ALTR), a global leader in computational intelligence, has been added to the S&P MidCap 400 by S&P Dow Jones Indices. The trading is scheduled to begin once the market opens on Monday, June 24.

KKR & Co Inc. (NYSE:KKR), CrowdStrike Holdings Inc. (NASD: CRWD), and S&P MidCap 400 constituent GoDaddy Inc. (NYSE: GDDY) will replace Robert Half Inc. (NYSE:RHI), Comerica Inc. (NYSE:CMA) and Illumina Inc. (NASD:ILMN) in the S&P 500 respectively.

Illumina will replace GoDaddy in the S&P MidCap 400. Robert Half and Comerica will replace Anywhere Real Estate Inc. (NYSE:HOUS) and ADTRAN Holdings Inc. (NASD:ADTN) in the S&P SmallCap 600. Illumina announced its intention to spin-off a company later this month.

Texas Pacific Land Corp.(NYSE:TPL), BioMarin Pharmaceutical Inc.(NASD:BMRN), Warner Music Group Corp. (NASD:WMG), Nextracker Inc. (NASD:NXT), Altair Engineering Inc. (NASD:ALTR), and RB Global Inc. (NYSE:RBA) will replace Werner Enterprises Inc. (NASD:WERN), Integra Lifesciences Holdings Corp. (NASD:IART), PENN Entertainment Inc. (NASD:PENN), Grocery Outlet Holding Corp. (NASD:GO), Leggett & Platt Inc. (NYSE:LEG) and Hertz Global Holdings Inc. (NASD:HTZ) in the S&P MidCap 400 respectively.

Leggett & Platt, Hertz Global Holdings, Grocery Outlet Holding, PENN Entertainment, Integra Lifesciences and Werner Enterprises will replace Methode Electronics Inc. (NYSE:MEI), Chatham Lodging Trust (NYSE:CLDT), Northfield Bancorp Inc. (NASD: NFBK), Xperi Inc. (NYSE:XPER), Resources Connection Inc. (NASD:RGP) and ATN International Inc. (NASD:ATNI) in the S&P SmallCap 600 respectively.

(Source: spsglobal website)

Krystal Biotech Inc. (NASD:KRYS), Virtu Financial Inc. (NASD:VIRT), StepStone Group Inc.(NASD:STEP), Cactus Inc. (NYSE:WHD), and Tidewater Inc. (NYSE:TDW) will replace OraSure Technologies Inc. (NASD:OSUR), The Marcus Corp. (NYSE:MCS),TTEC Holdings Inc. (NASD:TTEC), Medifast Inc. (NYSE:MED), and Cerence Inc. (NASD:CRNC) in the S&P SmallCap 600 respectively.

The changes in the indices ensure each index is more representative of its market capitalization range. All companies being added to the S&P 500 are more representative of the large-cap market space, all companies being added to the S&P MidCap 400 are more representative of the mid-cap market space, and all companies being added to the S&P SmallCap 600 are more representative of the small-cap market space. The companies being removed from the S&P SmallCap 600 are no longer representative of the small-cap market space.

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization. S&P 500 has managed to generate nearly 26% returns over the last 12 months.

The S&P 400 is used as a standard for mid-sized businesses. The 400 mid-sized companies that make up the index are chosen to represent the unique risk and return characteristics of this market segment through their performance. S&P 400 has managed to generate nearly 17% returns over the last 12 months.

The S&P SmallCap 600 seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. S&P SmallCap 600 has managed to generate nearly 10% returns over the last 12 months.

This week, another company is to be added to the S&P MidCap 400 index. Ryan Specialty Holdings Inc. (NYSE:RYAN) will replace Apartment Income REIT Corp. (NYSE:AIRC) in the S&P MidCap 400 effective before the opening of trading on Friday, June 28. Blackstone Inc. (NYSE: BX) is acquiring Apartment Income REIT in a deal expected to

be completed soon, pending final closing conditions.