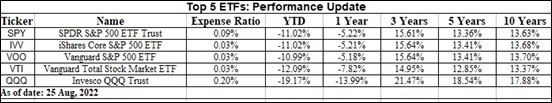

S&P 500 and Nasdaq 100 stock market indices are down by almost 12.58% and 21.39% respectively over the last 12 months. Many top stocks of these indices are down by an even more percentage. Investors who want to get exposure to all the stocks represented by an index consider investing in exchange-traded funds (ETFs). Instead of buying individual stocks, ETF gives one access to buy all stocks of the index in a single investment.

S&P 500 and Nasdaq 100 are two leading stock market indices followed by investors world over to track the performance of equities. Investors globally have the access to investing in the US stock market by buying individual shares of top global companies and also participating in the equity through exchange-traded funds (ETFs).

Also Read: Which exchange-traded funds to buy in India to start investing in the stock market?

One can buy stocks of some of the most popular US stocks like Facebook, Apple, Amazon, Netflix, and Google shares (together referred to as FAANG stocks), but there are also many ETFs that have these stocks as the underlying securities.

Also Read: ETFs to buy for the long term when the stock market is down in 2022

An ETF is a kind of mutual fund type that follows a certain index. Only on a stock exchange during trading hours the ETF’s units may be purchased or sold. ETFs are low-cost investments that enable one to gain exposure to multiple stocks belonging to the same index simultaneously. All ETFs have a distinct Ticker symbol, much like stocks.

Some ETFs track a specific sector and not all are index-benchmarked. The US stock markets offer a number of ETFs that track the banking industry or tech stocks. If you want exposure to banking equities, Vanguard Financials (VFH) is an ETF that will work for you. Similar to this, the Nasdaq-100, an index of 100 of the biggest non-financial companies listed on the Nasdaq Stock Market, is tracked by the Invesco QQQ ETF. Through this ETF, investors can gain exposure to FAANG firms as well as the blue-chip Tesla and a number of other tech businesses.

The SPDR S&P 500 ETF is a very well-liked exchange-traded fund (ETF) that tracks the S&P 500 index, which represents a diverse group of large-cap US corporations from a range of eleven key industries. It is preferable to purchase an ETF that provides exposure to the entire index if you are unclear about which index stocks will do well over the long run.

ETFs allow you the chance to make a single investment that covers all of the index stocks or a number of firms in the same sector. The growth stocks that have the potential to produce a significant return over the coming few years must all be included in your investment portfolio, after all. Purchasing an ETF makes it simple to gain exposure to several stocks that are part of the same index or industry. With an ETF, you get real-time prices as trading occurs throughout market hours, and ownership costs are comparatively cheap.