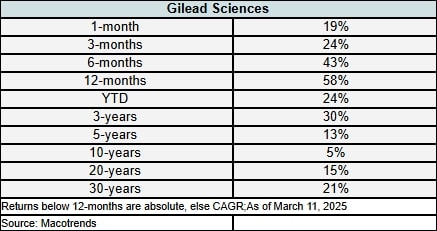

Gilead Sciences, with a market capitalization of $143.8 billion, is the only Nasdaq-listed business that has remained in the green during different time horizons. This makes Gilead Sciences a unique Nasdaq gem that has not disappointed its stockholders in a long time.

The consistent performance displayed by Gilead Sciences during the short, medium, and long-term periods is validated in the table below.

What is the company into? Gilead Sciences is a company that works on finding better ways to treat, prevent and possibly cure HIV.

Their researchers have created 12 HIV medications, including:

- The first single-pill treatment for HIV

- The first medicine to help prevent HIV in people at risk

- The first long-lasting HIV treatment that only needs to be given twice a year.

- Gilead is also known for its treatments for HIV and hepatitis C, like Biktarvy, Truvada, and Harvoni.

Companies valued at $10 billion or above are, typically, characterized as ‘large-cap stock’ and Gilead Sciences fits the bill for investors looking to invest in a non-tech large cap US stock.

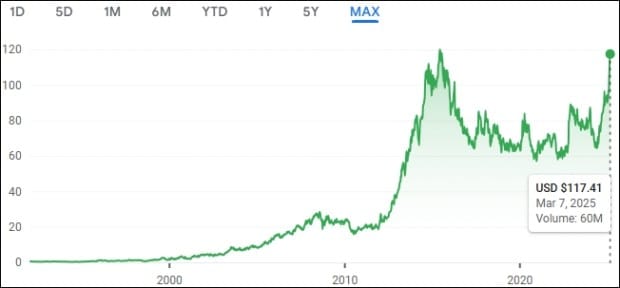

Currently, the stock is near its all-time high level, reached in June 2015.

Source: Google Finance

Gilead’s financials look robust. GILD reported its Q4 earnings results on February 11, 2025. The company reported above-average Q4 adjusted earnings of $1.90 per share, up 10.47% from the same period last year. Additionally, its revenue surpassed Wall Street’s projections by a noteworthy 7.2% and increased 6.4% year over year to $7.57 billion.

For the company, the total full year 2024 revenue increased 6% to $28.8 billion compared to 2023, primarily due to higher sales in HIV, Oncology and Liver Disease, partially offset by lower sales of Veklury.

Source: Google Finance

Looking Ahead

The company is planning for the potential launch of lenacapavir in Summer 2025, with its unique opportunity to extend the reach of HIV prevention.

The Board declared a quarterly dividend of $0.79 per share of common stock for the first quarter of 2025. The dividend is payable on March 28, 2025, to stockholders on record at the close of business on March 14, 2025.

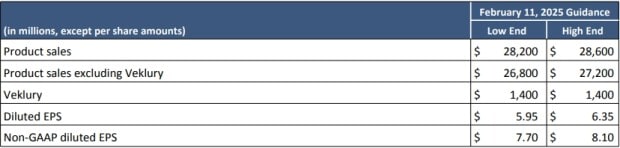

For the full-year 2025, Gilead expects:

Source: Company Release

Summing Up

The big tech stocks or the popular ‘Magnificent Seven’ stocks have had a rough start to 2025. Investors should diversify their stock portfolio across industries to manage risk. Within the pharma industry, Gilead Sciences could be the stock to study for the long term.

Disclaimer: Views, recommendations, and opinions expressed are personal and do not reflect the official position or policy of FinancialExpress.com. Readers are advised to consult qualified financial advisors before making any investment decision. Reproducing this content without permission is prohibited.