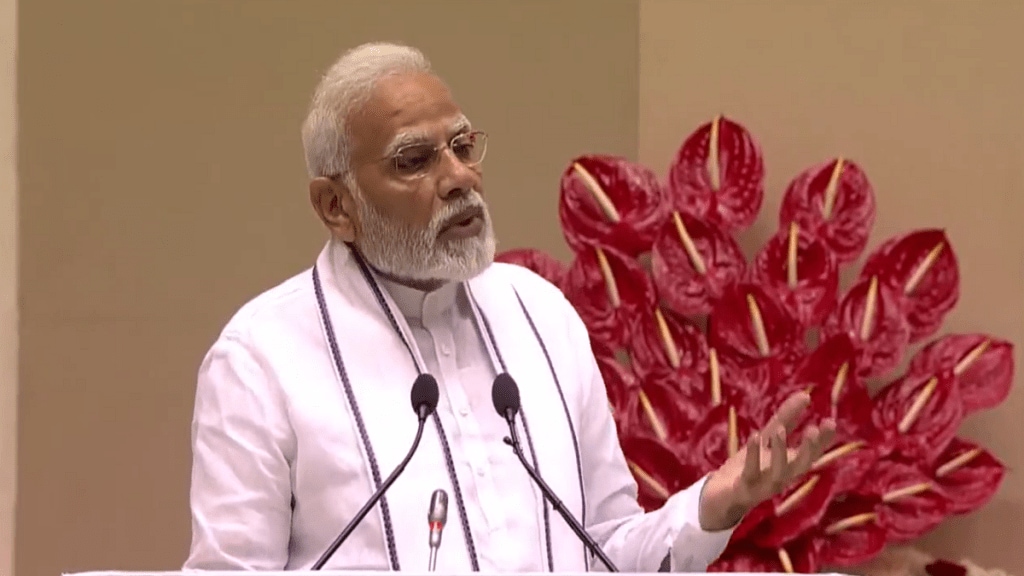

Credit and finance for MSMEs: Hailing the micro-credit scheme Mudra Yojana in enabling entrepreneurship in the country, Prime Minister Narendra Modi on Monday said that about 8 crore youngsters have become entrepreneurs for the first time with the help of these loans. PM Modi said so far, 38 crore Mudra loans have been given across the country with the “maximum share of women and young friends belonging to SC/ST/OBC classes.”

Addressing the Uttarakhand Rozgar Mela and the growth in tourism in the state, he said, “Mudra yojana is helping a lot in boosting employment and self-employment in tourism. Under this scheme, those engaged in businesses like shops, dhabas, guest houses, and homestays are getting loans up to Rs 10 lakh without guarantee.”

Also read: Rs 21.5 lakh crore loans under Mudra scheme sanctioned since launch: Economic Survey

According to the Mudra scheme data shared by the Minister of State in the Ministry of Finance Bhagwat Karad in the Lok Sabha on February 13, more than 38.58 crore loans were extended from the inception of the scheme in April 2015 till January 27, 2023. Out of this, over 26.35 crore loans were extended to women Entrepreneurs (68 per cent) and 19.84 crore loans to SC/ST/OBC category of borrowers (51 per cent).

Moreover, as per the Ministry of Labour and Employment (MoLE) survey conducted at the national level to assess employment generation under the Mudra scheme, the scheme helped in generating 1.12 crore net additional employment in the country during a period of approximately 3 years – from 2015 to 2018, the minister noted.

Also read: Mudra loan: Over 16 crore loans sanctioned, this much amount extended in last three FYs

The scheme provides collateral-free institutional credit by member lending institutions (MLIs) including scheduled commercial banks (SCBs), regional rural banks (RRBs), non-banking financial companies (NBFCs) and microfinance institutions (MFIs) to individuals with a business plan. The potential entrepreneur can avail a loan for income-generating activities in the manufacturing, trading, services sector and also for activities allied to agriculture across three loan products, viz. Shishu (loans up to Rs 50,000), Kishore (loans above Rs 50,000 and up to Rs 5 lakh) and Tarun (loans above Rs 5 lakh and up to Rs 10 lakh).

“We are constantly trying to ensure that every youngster gets new opportunities according to his/her interest and ability, and everyone gets the right medium to move forward,” PM Modi added.

In terms of portfolio quality of Mudra lenders, NPAs relating to Mudra loans were 3.17 per cent of the credit disbursed as of March 2022. According to Karad, lenders had disbursed Mudra loans of Rs 17.35 lakh crore between April 1, 2017 and November 25, 2022.

The 2nd edition of FE Aspire’s SMExports Summit is here. Register now to book your seats!