Home-grown retailer Shoppers Stop is likely to raise R150-R200 crore for its subsidiary HyperCity by selling 10% to 15% stake in the hypermarket by March 2017, a senior company official told FE on Tuesday. If the stake sale happens at this price then the company’s valuation would be around R1,500-R2,000 crore.

Shoppers Stop has 51% stake in HyperCity, the hypermarket format while K Raheja Corp holds the remaining 49%. Shoppers Stop had acquired 51% stake in Hypercity in 2010. “As of now we have not yet decided whose stake would be sold. It is open and depends on the valuation,” the official said.

Rajesh Vig, executive director, PricewaterHouse Coppers, said, “For the last three to four years the retail sector is not performing well if one sees on an overall level. HyperCity is also yet to turn profitable, given that the valuation more or less seems to be reasonable.”

Hypercity stores ranges from 20,000 sq ft to as high as 50,000 sq ft.

Arvind Singhal, chairman, Technopak said, “In the last six years post acquisition, Shoppers Stop has not yet managed to make HyperCity profitable. The company should have focused on opening stores in the metros rather than opening stores in locations like Amritsar and Jaipur, they have entered these markets too early. While the company is yet to be profitable the retail format has the potential to perform well going forward.”

Govind Shrikhande, managing director, Shoppers Stop, told FE, “Around R150 crore to R200 crore will be raised for HyperCity before March 2017. We have not yet decided the exact route of fund raising but a stake sell is not ruled out.” He declined to give further details.

Watch what else is making news:

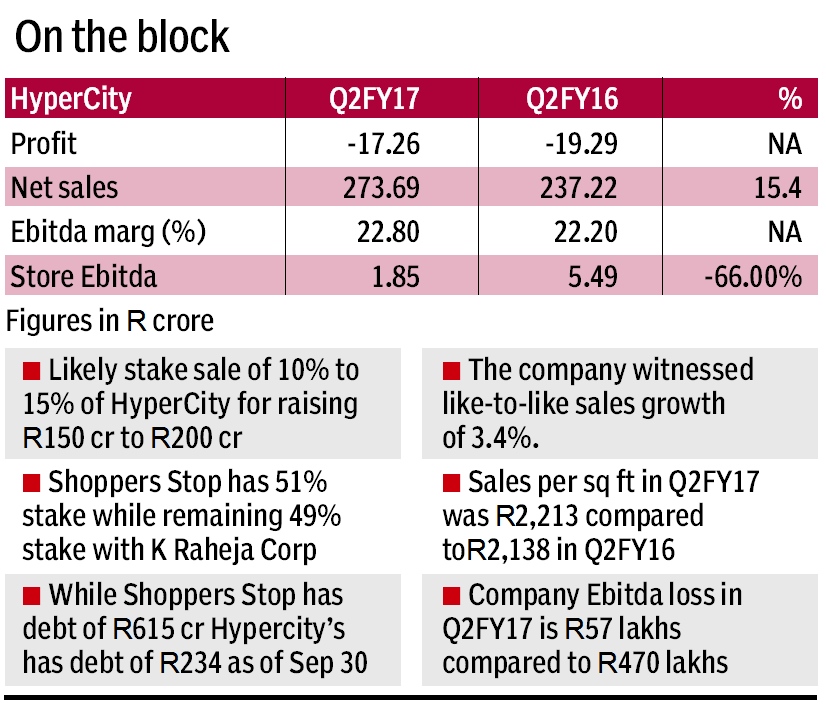

While Shoppers Stop has a debt of R615 crore, Hypercity has debt of R234 crore as of September 30, 2016. A year ago Shoppers Stop had consolidated debt of R856 crore which has reduced marginally. Loss of HyperCity in Q2FY17 dropped to R17.26 crore from R19.29 crore in Q2FY16. Sales of Hypercity was up by 15.4% from a year ago to R273.69 crore in Q2FY17. Company’s EBITDA loss reduced to R57 lakh from R470 lakh loss in Q2FY16.

The company witnessed like-to-like sales growth of 3.4%. Gross margin of the company was 22.8% in Q2 FY17 compared to 22.2% in Q2FY16.