RBS has abandoned plan to float a standalone UK bank Williams & Glyn (W&G). In 2013, it had awarded a 300-m-euro contract to INFO and IBM for W&G. RBS CEO Ross McEwan cited: “Given lower interest rate environment, it is clear that W&G would be unlikely to grow its balance sheet to the extent necessary to deliver returns above the cost of capital within the next five years”.

INFO has said that it has been a W&G programme partner, and subsequent to RBS’ decision, it will carry out a ramp-down of 3,000 employees, primarily in India.

Impact unlikely factored in current guidance, cutting estimates

INFO’s statement on August 13 follows RBS’ announcement, suggesting that the same is unlikely factored in its guidance of 10.5-12%. Even assuming predominantly offshore nature of the deal, we believe quarterly run rate from the account is unlikely to be below $25 million. As a result, we have cut our FY17e/18e $ revenue by 0.7%/ 1% and earnings by 0.8%/1%.

Valuation view

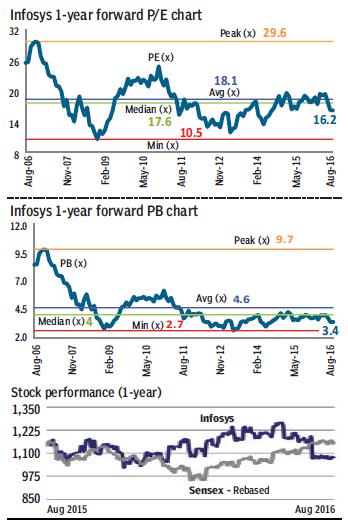

Soft start to FY17 followed by deal-specific pushback amid a challenging macro sets INFO’s recovery back a few paces. Negative news and further cut in growth expectations as a consequence will weigh on the stock. That said, significant downside to valuations at 17.1x FY17e/14.7x FY18e earnings would only come from loss of market share, with the near-term macro headwinds and their toll on INFO largely captured. Our greater concern is secular spending moderations within BFSI amid the current environment, defying any case for upside despite moderate valuations.

Journey to ‘Infosys of the future’ well and truly on

INFO’s strategy of ‘renew and new’ – renewing the way of delivering existing services and also building new services of the future —resonated with the changing landscape of technology demand. Successful execution of the strategy will help INFO regain its bellwether status with industry-leading growth.

Addressed various pain points under new management

Over the past 4-5 quarters (before 1QFY17), INFO’s improving traction is demonstrated in multiple areas: Volume growth has picked up gradually from 9.3% in FY15 to 14.5% y-o-y in FY16. Improvement in client mining—top-10 accounts, which were flattish till Q1FY15 have turned around impressively. Deal wins have picked up, with TCV of $2.8bn in FY16 being 45% higher than that in FY15. INFO hasn’t factored in an additional $440 million from deals that have been framed but not concluded. Flux in the senior management has been addressed. Standalone attrition declined from 18.9% in FY15 to 13.6% in FY16. Cost optimisation levers have helped deliver on margins despite pricing pressure.

After cost optimisation, pricing aggression puts margins in limelight

INFO’s cost structures have stabilised, allowing it to balance investments and profitability without having significant volatility on the margins. While there remains room to improve utilisation, these may in the best case offset the headwind from wage hikes and lower pricing. Velocity of benefits from new initiatives like automation will be crucial, in the absence of which, execution on the margins will get challenging. However, we see this as a sector-wide phenomenon and believe outperformance on revenue growth will aid relatively better show on profitability too.

Cut estimates, but expect growth to revive in 2Q

We have cut our $ revenue estimates for FY17/18 by 2.4%/3.2% and earnings estimates by 5.5%/4.3% respectively. INFO had steadily addressed the concerns under new management over last 18 months around revenue growth, operating margins and new age services. A soft start in the challenging macro pushes the recovery back a few paces, and growth rebound in 2Q will be crucial for industry-average growth in FY17. Momentum in top-25 accounts and deal wins lend confidence towards that end.

Uncertainty limits triggers in the near term

The stock trades at 17.0x/14.6x on our FY17e/18e earnings. We expect INFO to grow its revenue at a CAGR of 10.6% over FY16-18 and EPS at a CAGR of 10.7% during this period. We believe that INFO is investing in all the right areas to regain and sustain its growth leadership, compounded by industry leading margins. Our price target of Rs 1,300 discounts two year forward earnings by 18x. Notwithstanding the headwinds over the near term, INFO’s gradual recovery to industry-matching industry-leading growth at a strong margin will command a premium to peers. Maintain buy.