Indian IT is at the crossroads of slowing discretionary spending and increasing cost take-out initiatives.

The country’s leading software players are heading into a weak phase as clients’ budgets are expected to moderate in 2023. The slightly slower growth in IT spends come after two years of aggressive spending. “While budgets will be a focus area, IT services management may not have full visibility. It is also plausible that there may be a delay in the conversion of budgets into spends/projects,” analysts at Kotak Institutional Equities wrote. In a somewhat weak demand environment, some of the companies are vulnerable to slowing revenue growth and must execute efficiently.

They observed that clients have become increasingly more focused on the ROI. “Talks of cost take-out deals and vendor consolidation are back,” they said adding that vendor consolidation has many flavours, which in some cases will be net-neutral for the industry, gains for a few and loss for others. Companies that have a full-service model, strong execution engine and address digital transformation agenda are best-positioned to gain.

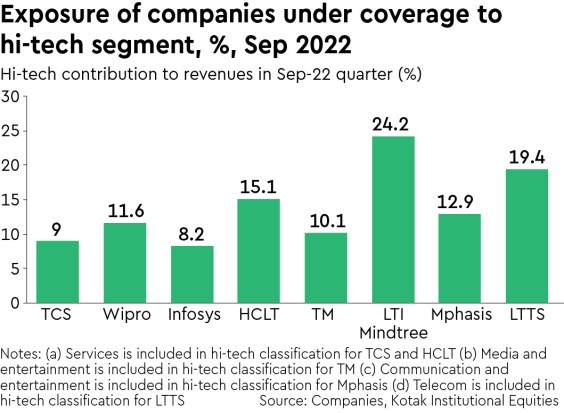

The slowdown in specific segments of the market, such as mortgages, hi-tech, segments of retail and telecoms, will lead to moderation, the analysts pointed out, explaining, ‘the slowdown is in sync with the deterioration in the external environment”. Again, furloughs have been higher than usual, especially in the hi-tech segment. The analysts observed that certain segments of the market may slow down. This includes non-essential retail, segment of telecom and financial services. “We note that the industry escaped the furlough impact in the last two years due to compressed digital transformation journey as well as large-deal ramp-up,” they wrote.

Consequently, the sequential revenue growth for software players, in the December quarter could be subdued and in the range of 0-3%, courtesy deteriorating macro and furloughs. At the same time, the operating margin (earnings before interest and tax) has bottomed out and should see an improvement, even if it is a modest one. The cross-currency tailwinds are expected to range from 10-60 bps. There could have been a bigger improvement but for furloughs. The primary drivers for the better margins include the depreciation of the rupee against the US dollar and other currencies and the employee pyramid. Moreover, the fading supply-side pressures and lower subcontracting costs would aid the margins. Importantly, seen from a y-o-y perspective, the EBIT margin will likely decline 25-295 bps.

In general, the leading software services companies are not expected to announce exciting contracts though there could be exceptions; some of the deals that have been announced, during the quarter, are interesting. The current fiscal could end on a cautionary note given March is a seasonally weak quarter for Indian IT companies.