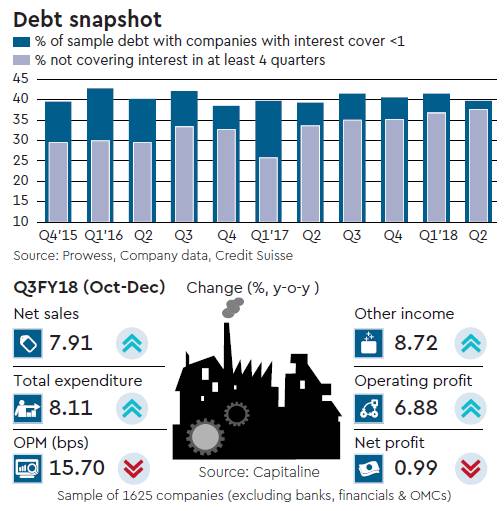

The September quarter earnings season may have turned out to be the best in several quarters but the big concern is that corporate India remains highly leveraged. Consequently, any deterioration in the macroeconomic environment could hurt corporate profits crimping their ability to repay loans. As analysts at Credit Suisse point out, the share of debt with companies that have an interest cover of less than one saw little change during the September quarter at 40%, only slightly better than the 42% in Q1FY18. This improvement too is the result of Tata Motors having exited the sample. Else, the share of chronically stressed debt — firms which have had an interest cover of less than one for the last four quarters — actually increased 100 basis points quarter-on-quarter to 38%. The revival in prices of commodities notwithstanding, aggregate debt remains elevated while the ability of companies to repay their loans doesn’t seem to have improved significantly.

In the case of steel producers, for instance, the share of debt where the interest cover is less than one remains at a very high 55%. Also, the share of debt with loss-making companies remained at a high 29%. As such, while analysts believe earnings may have s, the commentary is very cautious. Many expect earnings to grow by about 20-25% in 2018-19, driven by a rebound in profits for the banking sector which is expected to contribute substantially to the earnings in 2018-19. The caution stems from the slight deterioration in macroeconomic parameters — the current account deficit, the fiscal deficit and inflation — could deteriorate following the reversal in the prices of crude oil in the last month or so.

The BSE 100 companies posted a good September quarter, probably the best in three years; sales grew 10% year-on-year though excluding metals and oil, the increase was a more modest 7% year-on-year. Operating profits for the 100 companies rose a robust 14% year-on-year. At an aggregate level, however, the performance is somewhat less impressive. For a sample of 1,625 companies (excluding banks and financials), profits stayed flat in Q2FY18; revenues grew 8% year-on-year but with the increase in the total expenditure at just over 8% year-on-year, operating profit margins were crimped, contracting by about 16 basis points.