India’s insolvency landscape witnessed mixed developments in FY2025, with a marginal decline in the number of approved resolution plans and a sharp drop in cases admitted under the Corporate Insolvency Resolution Process (CIRP). Per an analysis report by ICRA, the number of resolution plans (RP) approved by the National Company Law Tribunal (NCLT) under the Insolvency and Bankruptcy Code (IBC) showed a marginal dip to 259 cases from 263 cases approved in FY2024. At the same time, it added, the number of cases admitted in the corporate insolvency resolution process (CIRP) dipped sharply to 724 from 1,003, reporting a decline of nearly 28 per cent.

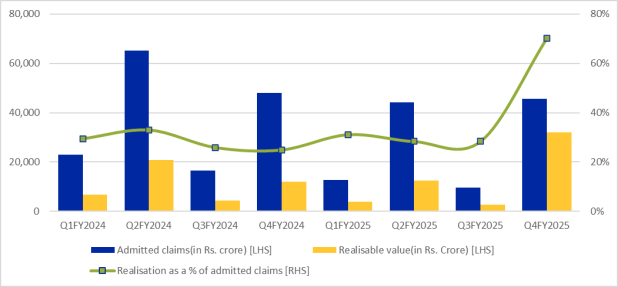

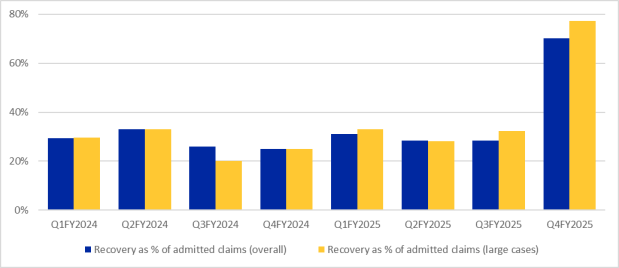

While Q4FY25 has seen peak realisations of approximately 70 per cent against admitted claims, ICRA maintained that a sustained momentum would be needed to minimise haircuts for lenders, which remain high at 67 per cent.

IBC was introduced in 2016, and since then, an overall 8,308 corporate debtors have been admitted, of which 61 per cent CIRPs have been resolved (either through a successful resolution plan or withdrawal or liquidation) by end-March 2025. For these cases, ICRA said, the limited recovery through the successful resolution plan has seen an estimated rate of 33 per cent.

Manushree Saggar, Senior Vice President and Group Head, Structured Finance Ratings, at ICRA, said, “The IBC, despite its shortcomings, continues to deliver better realisations for creditors over other recovery modes. Historically, resolutions from the IBC have been plagued by long resolution timeframes, high share of liquidations and sizeable haircuts.”

While FY2025 was positive with improved realisations, the overall resolution time remains a cause for concern. Manushree Saggar added, “Almost 78 per cent of the ongoing CIRP cases have exceeded 270 days, post admission by the NCLT, as on March 31, 2025. Nevertheless, some of the recent judgments reinforce the need for timely and transparent resolution, thereby putting greater onus on the Committee of Creditors (CoC) and NCLT.”

However, she maintained that such rulings may also impact investor confidence in stressed assets setting precedents that the decision made by the CoC and the NCLT may be challenged and overturned by the judicial system, thus impacting the effectiveness of the resolution process.

Per ICRA, prolonged delays and judicial interventions impact recovery for lenders adversely and thus greater regulatory clarity and adherence of stakeholders to the code is critical for its success.

Empirical data showed that when resolution plans succeed, about 33 per cent of the money is recovered, which is much better than the 4 per cent recovery seen in liquidation. This supported the higher recoveries in Q4FY25, as resolutions outpaced liquidation orders during this period.

The record recovery in Q4FY25, ICRA said, was led by a few large cases (admitted claims > Rs 1,000 crore) where 77 per cent recovery was achieved against the admitted claims. These large cases had approximately 90 per cent share in recovery but only 10 per cent share in approved resolution plans.

Thus, ICRA concluded that better recovery in large cases is key to making the insolvency code work well. Also, to improve the efficiency of NCLT, especially since it often gets stuck with small cases, it’s important to use special processes like the Pre-packaged Insolvency Resolution Process (PPIRP), even though it hasn’t been very successful yet.

According to ICRA’s analysis, the ratio of resolutions to liquidations improved to 0.9 in FY25 (1.9 in Q4), up from 0.6 in FY24. However, the average time for resolution also increased to 713 days by March 31, 2025, compared to 679 days a year earlier, which is significantly higher than the IBC deadline. To fix this, the Insolvency and Bankruptcy Board of India (IBBI) made changes to the IBC in Q4FY25 to make the auction and liquidation processes more efficient. These changes aim to standardize asset sales, attract more bidders, and help creditors recover more money.